I read an article by a largely followed investment blogger introducing EA Holdings and complimenting its financial performance. I however feel he is overly optimistic.

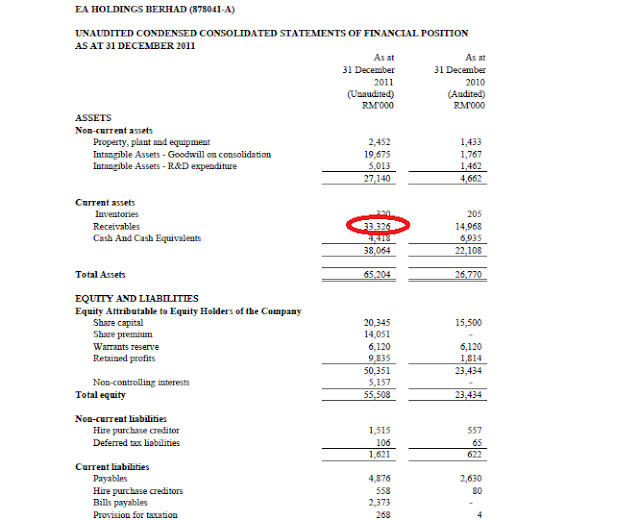

Look at the 2 numbers circled in red as below:

Revenue for the year - RM36,551,000

Total Receivables as at 31 Dec 2011 - RM33,326,000

Receivables turnover - 1.09 times (36,551 / 33,326)

Yes, Net Profit grew from RM4 million to RM11.76 million in FY2011. But what kind of business takes almost a year to collect? Is this a case of the company trying too hard to flip up to Main Board? At Market Capitalization of RM64 million, is this justified for a company who is soooo poor at collecting? Do they need to write off the receivables in years to come? Or is it just another case of the sales figure are not real?

Hmmm. remember Transmile! Or check out my other post on how do we know receivables numbers to be real.

Serious Investing!

1 comment:

May I know beside checking the receiable / revenue - days to collect money.

whatelse do we need to check? Sorry I want to be a serious investor but I too weak in fundamental anlysis...

I just know to read Chairman statement, revenue+profit increase or not...

how to check the cash flow statement?

Hope you can teach me

Post a Comment