Anyway, as we know - the world is transitioning. We are seeing the clash of two superpowers - US and China. When two superpowers collide, are we the pelanduk (mousedeer) that will die in between (a Malaysian proverb - Dua Gajah bertarung, pelanduk mati in tengah-tengah).

Malaysia, coincidently is not taking sides - particularly in business. We are exporting to both countries. We do business with both countries - business and politically.

In dealing with trade wars, we have to be really in the know what type of companies and business we are dealing with. Semiconductor company - in this particular case - VS Industry - a downstream player - also called a box builder. It is one of the largest South East Asian owned box maker - i.e. the one that assembles, value adds and helps one of its customers, Dyson to manufacture its vacuum cleaners. Dyson for your knowledge does not own a single factory - just like Nike's model - or closer Apple.

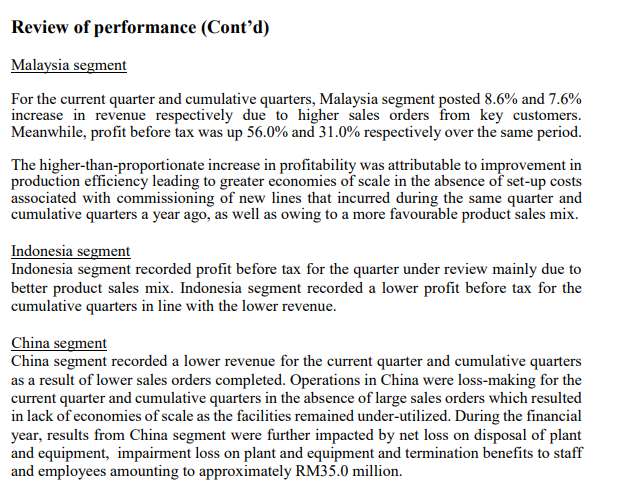

In this article, I am not going to mention in detail the business of VS but what it has announced recently and where some of our companies in Malaysia will be heading - not the next few quarters alone but the next few years at least. As a summary, VS Industry has businesses in three countries - Malaysia, China and Indonesia (as below latest results - 4Q19).

Malaysian revenue comprise of 80% of its total revenue. Surprisingly, revenue from Indonesian operations has dropped while unsurprisingly revenue from China dropped even further. As we can see, Malaysia is highly profitable and China is making losses. Indonesia is barely breaking even. China's losses as it has mentioned is because the company seems to be downsizing in that country - not surprising. VS is taking a financial hit in China as it seems that they are focusing harder in Malaysia.

So, what we are seeing is a business where Malaysia is somewhat strong in among our competitor countries like Singapore, Indonesia, Thailand and China (which overtook us by far in the last 2 decades). As below is the explanation as provided by the management of VS which I tend to believe and agree. (no point rewriting them as I can make use of the wonders of cut and paste)

As mentioned above, we know already given that if we do some "reading and watching" and if we know the geopolitical and cross border business perspective, it is the start of where we see what we may see more in the near and medium term future.

More and more businesses are looking out of China - still the factory for the world, and Vietnam and Malaysia will get more queries. The above performance, I see as just the beginning - for VS and few more companies in Malaysia. This is the reason why I am betting on PIE Industrial. PIE, to me could be even better as it is largely only Malaysian operation and does not have operations in China - the setback that we see through VS. The weakness for PIE though is that it is smaller than VS and it is Taiwanese controlled.

Given that if I have time, I will share more of my opinion on export businesses in Malaysia and the trade which I have been spending a lot of time and my current dealings in.

I am though a little bit not satisfied that we start to see this trend as above through VS and several more, but I do not think the "G" i.e. "government, side is doing enough. There are opportunities I think with this trend, moving forward. VS, by the way is doing quite well as a company and management given that they are managing the transitioning - it is not easy.