I love Airasia as an innovative company. It has the leadership, management, right mindframe to be on top of the leaderboard among the airlines regionally. However, as I have always mentioned before airline business has a huge danger - continuous support from government due airline being considered for its sovereignty. No country can do without its national airline - that's the thought of most leaders.

The public can accept it if there is no national airline. Government officials cannot. The bailout of MAS is precise why Airasia always has that danger in among its competition. Imagine if Airasia is facing financial trouble...it will just go bankrupt. It is unfair competition. MAS can fail but Airasia cannot. And in fact many other airlines regionally have failed - Thai Airways, Garuda, Japan Airlines. Qantas is facing some challenges as well.

How many times have there been rescue plans for MAS and I am quite it will not be the last.

Saturday, August 30, 2014

Tuesday, August 26, 2014

Have we not learned?

This same thing I have seen over and over again in my life as an investor / stock trader. If you know what I mean, the year 2014 appears to be a speculative year again. People just like the excitement although they do know that what they are doing is a negative sum game. If it is a negative sum game, why bother? Well, if you look at Genting or Genting Malaysia's shares, we can basically understand - there is never a year where Genting will be on the losing end but still people will just like to take that bet - hoping that their luck will be good that day.

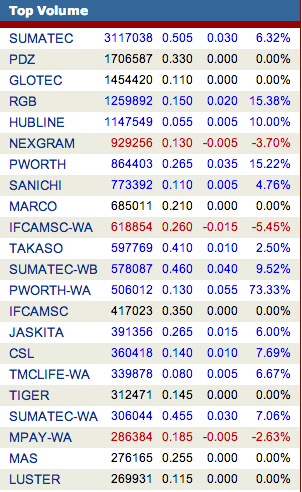

The last few months, it has been a good time for penny stocks, in which case most of them have little investment value. One who have been into stocks market long enough would know that any deals that are announced are just useless deals, but they are welcomed with hope, just like those who goes to a casino in Genting.

I have started tinkering with the market since the early 90s and I have seen this large speculative period in 1992/93 (basically on all stocks including loan stocks), 1996/97 (especially second boarders and could have indirectly caused the collapse of the economy), 2004 (MESDAQ counters, to the extent that Bursa changed the name to ACE Market?) and more recently but less dramatic (the penny stocks). Little do I see the same group of people excited over the same speculative period. Why? Because they have left the market getting burned.

For those whom are still living with that excitement of thinking that you can beat the market this way, well look at it - the world is getting more connected. Systems can get more complex which means that the person can trade from overseas, and not being tracked. They can create an account trading under a foreign company. They have all the information about the stocks and market while those who follow blindly (but thinking they have the information) are just playing to their tunes.

Just read some of these news here and here and here. The point I am trying to make is not on the people whom SC is trying to nab but the stocks. How many of these stocks are still around? Do anyone think they can really beat the market this way by trading on the useless, low value stocks?

Many do not know the best way for any investor to learn is to spend time learning about the business and companies - not the trading patterns. Even for those traders, they have a very strong understanding and hold of the market behaviour, economic conditions and positions of the controlling shareholders. They are not really read through the market movements and take a bet.

The last few months, it has been a good time for penny stocks, in which case most of them have little investment value. One who have been into stocks market long enough would know that any deals that are announced are just useless deals, but they are welcomed with hope, just like those who goes to a casino in Genting.

I have started tinkering with the market since the early 90s and I have seen this large speculative period in 1992/93 (basically on all stocks including loan stocks), 1996/97 (especially second boarders and could have indirectly caused the collapse of the economy), 2004 (MESDAQ counters, to the extent that Bursa changed the name to ACE Market?) and more recently but less dramatic (the penny stocks). Little do I see the same group of people excited over the same speculative period. Why? Because they have left the market getting burned.

For those whom are still living with that excitement of thinking that you can beat the market this way, well look at it - the world is getting more connected. Systems can get more complex which means that the person can trade from overseas, and not being tracked. They can create an account trading under a foreign company. They have all the information about the stocks and market while those who follow blindly (but thinking they have the information) are just playing to their tunes.

Just read some of these news here and here and here. The point I am trying to make is not on the people whom SC is trying to nab but the stocks. How many of these stocks are still around? Do anyone think they can really beat the market this way by trading on the useless, low value stocks?

Many do not know the best way for any investor to learn is to spend time learning about the business and companies - not the trading patterns. Even for those traders, they have a very strong understanding and hold of the market behaviour, economic conditions and positions of the controlling shareholders. They are not really read through the market movements and take a bet.

Wednesday, August 20, 2014

Not Muhibah

Muhibbah came out and clarify that they are not related to the company, Syarikat Muhibah Perniagaan dan Pembinaan Sdn Bhd which was involved in the MRT project which had caused several fatalities.

Have not really heard of the Muhibah contractor but the recent number of accidents seems to point to something is wrong in our selection of contractors.

Have not really heard of the Muhibah contractor but the recent number of accidents seems to point to something is wrong in our selection of contractors.

Jobstreet's revised sale price to RM1.89b

Just yesterday, Jobstreet announced a revision in its sale price to Seek which below is self explanatory.

The special dividend hence is being revised to RM2.62.

One should note the following:

- post dividend distribution, the Net Asset value of Jobstreet will still be around RM0.40 per share;

- the sale has yet to be approved by Singapore's anti-competition body. Expected decision to be before 31 October 2014.

Whether I am confident of the approval? I would say yes, although this is taking longer than expected. Nevertheless the longer approval is a blessing in disguise as this allows change in purchase price by Seek.com.

Remember my article on undervaluation of Jobstreet by Seek.com. This seems to be a reprieve.

The special dividend hence is being revised to RM2.62.

One should note the following:

- post dividend distribution, the Net Asset value of Jobstreet will still be around RM0.40 per share;

- the sale has yet to be approved by Singapore's anti-competition body. Expected decision to be before 31 October 2014.

Whether I am confident of the approval? I would say yes, although this is taking longer than expected. Nevertheless the longer approval is a blessing in disguise as this allows change in purchase price by Seek.com.

Remember my article on undervaluation of Jobstreet by Seek.com. This seems to be a reprieve.

Tuesday, August 19, 2014

Parkson's sale of KL Festival Mall

The sale of KL Festival Mall does seem weird as it is to my understanding that one of strategy of Parkson sealing its future moves of reducing the risk of increasing costs of rental rates is to own those malls directly. However, it seems that its sale of the Mall is like taking the other direction. However, based on the rationale for the sale, it seems that it does make sense.

With a smaller mall, it is probably harder to be part of the town planning. If one look at how Aeon Malaysia does it, they do it very well. Usually, the township planning comes with a medium to larger sized mall and brands like Parkson, Aeon or even Giant or Tesco will provide added value to the township. The KL Festival Mall is on already a matured township and it is harder for Parkson to grow from there. Developers would want to work with shopping mall operators to build the township and I think Parkson's move may still be a step towards the right direction.

In searching for Parkson's strategy moving forward, I have added the article here.

With a smaller mall, it is probably harder to be part of the town planning. If one look at how Aeon Malaysia does it, they do it very well. Usually, the township planning comes with a medium to larger sized mall and brands like Parkson, Aeon or even Giant or Tesco will provide added value to the township. The KL Festival Mall is on already a matured township and it is harder for Parkson to grow from there. Developers would want to work with shopping mall operators to build the township and I think Parkson's move may still be a step towards the right direction.

In searching for Parkson's strategy moving forward, I have added the article here.

Saturday, August 9, 2014

Making sense of capital expenditure

I am sorry that I love to look at how sometimes accounts can or MAY be manipulated. Just looked at some of the companies again (hmmm...) Bright's rights issue. Sometime around last year, it announces something like this. I had some of my opinion here although it may not be relevant to what I am trying to highlight in this article.

The company announced the rights issue and mentioned how some parts of its cash from rights are going to be used (as below). It does say that RM11 million of it is going to be used for ERP system.

Usually a RM11 million ERP system will take months if not years to complete. And payments are not made in one lump sum but in staggered basis over the period of completion. However see below. The rights was completed in 23 January 2014 and RM36.9 million was out by 28 February 2014 - in about 1 month. And as I said, ERP system (RM11 million system that is) hardly can be completed within a month. Could it be that payment for ERP is already fully completed? How efficient is the payables department...

Does this warrant further checks? Note that the current auditor - Bakers Tilly - is withdrawing and to be replaced with UHY.

Note: I am not saying that the company is doing anything wrong, but some of the figures and how things are done is really tickling my mind!

The company announced the rights issue and mentioned how some parts of its cash from rights are going to be used (as below). It does say that RM11 million of it is going to be used for ERP system.

Usually a RM11 million ERP system will take months if not years to complete. And payments are not made in one lump sum but in staggered basis over the period of completion. However see below. The rights was completed in 23 January 2014 and RM36.9 million was out by 28 February 2014 - in about 1 month. And as I said, ERP system (RM11 million system that is) hardly can be completed within a month. Could it be that payment for ERP is already fully completed? How efficient is the payables department...

Note: I am not saying that the company is doing anything wrong, but some of the figures and how things are done is really tickling my mind!

Wednesday, August 6, 2014

Keuro's warrants: Why 2 years exercise period

I have posted several times about the different traits of a Warrant here. There are cases where warrants act as a sweetener for the shareholders to subscribe to the rights. Warrants can also be used as a tool for companies to raise more funds - not immediate but within the exercise-able period. This is especially true when the warrants is in the money. Usually the exercise period for warrants in Malaysia is either 5 years or 10 years, hence allowing the shareholders time to exercise it.

If it is for the management and controlling shareholders tool as a play, they may issue the warrants to be used as a unit just for sale. Why would one have more dilution to their stocks if they do not meant to exercise it? In this cases, one can see that the warrants have very little value but since it is tradeable and usually it is low in price. Recently, with the trading charges so low, at every 0.5sen, the traders are already profiting. That's precisely what I was pointing at in one of the articles. If the warrants in the eyes of the shareholders is not worth the money, and they do not want to cough up more to pick up more shares, they usually sell. Let the fools have it, why not!

In the case of Keuro's warrants, I believe it is used as a sweetener as well as a tool to raise additional funds - funds that Keuro does not need now but over the next 2 years it will need. As most know Keuro is raising funds for its WCE project which is costing RM5.9 billion now. Usually, these projects the cash needed are not immediate but will be needed on progress over the next 4 -5 years of the project duration. This is precisely why the exercise period is 2 years and not 5 years as if it is 5 years, it may be too late to raise the cash anyway. In 5 years time, Keuro does not need the cash. It needs it earlier. This is also probably why the exercise price is put at a lower price - RM1.18, closer to the parent price.

Whether the warrants will be exercised will depend on whether it is in the money. As it is the exercise price is RM1.18. Today, Keuro's price RM1.10 where it is pretty close to the exercise price.

If it is for the management and controlling shareholders tool as a play, they may issue the warrants to be used as a unit just for sale. Why would one have more dilution to their stocks if they do not meant to exercise it? In this cases, one can see that the warrants have very little value but since it is tradeable and usually it is low in price. Recently, with the trading charges so low, at every 0.5sen, the traders are already profiting. That's precisely what I was pointing at in one of the articles. If the warrants in the eyes of the shareholders is not worth the money, and they do not want to cough up more to pick up more shares, they usually sell. Let the fools have it, why not!

In the case of Keuro's warrants, I believe it is used as a sweetener as well as a tool to raise additional funds - funds that Keuro does not need now but over the next 2 years it will need. As most know Keuro is raising funds for its WCE project which is costing RM5.9 billion now. Usually, these projects the cash needed are not immediate but will be needed on progress over the next 4 -5 years of the project duration. This is precisely why the exercise period is 2 years and not 5 years as if it is 5 years, it may be too late to raise the cash anyway. In 5 years time, Keuro does not need the cash. It needs it earlier. This is also probably why the exercise price is put at a lower price - RM1.18, closer to the parent price.

Whether the warrants will be exercised will depend on whether it is in the money. As it is the exercise price is RM1.18. Today, Keuro's price RM1.10 where it is pretty close to the exercise price.

Subscribe to:

Posts (Atom)