Just when will Bursa put a stop to this - minority shareholders are going to have no say in this. Any acquisitions that are cash in nature does not need shareholders approval and management as well as the controlling shareholders continue to take advantage of this.

Another deal which took opportunity of this another smallish company. Fresh from its rights issue, raising RM42.5 million it took the opportunity to have a spending spree, buying a less than 1 year old company. See for yourself - a company that was incorporated on 11 Sep 2013. The rights issue was created it seems partly to acquire this company. Otherwise, how can the deal be done in such a short timeframe? - a month after the rights.

Why is it fishy?

1. The announcement claims that it makes RM2.01 million profit - it has a track record for less than 1 year. How are we suppose to evaluate a less than a year old company? The fact that it achieves such a high net margin especially in short period of time causes some concerns already;

2. Another part of the announcement mentioned that it still has unbilleable contract worth RM4.94 million. One of the contract started before the company was even formed. How is it so? Contracts are transferred i.e. assigned?

3. Beyond the mention of its PAT, comparison against currently traded PEs of similar companies not much was revealed. How about showing the audited report of the acquired company?

For those whom have come out with money to subscribe for the rights earlier, good luck!

Showing posts with label EAH. Show all posts

Showing posts with label EAH. Show all posts

Saturday, July 26, 2014

Monday, July 2, 2012

EAH: Don't fall into the bad assets trap

This is not a company one should bother looking at, however I am pulling out the Balance Sheet of the company to highlight how bad the asset portion can be for the company. Yes, assets can be bad as to liabilities can be good! It is not confusing while I will just highlight on a company with bad assets today and present another that has a presumingly good liabilities on another article.

EAH's Balance Sheet

Notice the remark side below. What consists of bad assets i.e. one which you do not want to have, as too much can be a bad thing. For EA below, you can assume that it reportedly has a Net Asset of RM55.5 million. Well, this is what it reports in its Annual Report but what it does not highlight in the chart section is that its intangible asset is RM24.7 million. Hence making its Net Tangible Asset at RM30.8 million. Not so great yeah since I have not heard of the company before and its intangible strength may not be of a Coca-cola or even Apple. How valuable are the intangibles really? If you look further, EA bought an IT company call DDSB Sdn Bhd in August 2010 for RM19.4 million and due to that purchase, close to RM18 million is consolidated as goodwill.

What other bad assets that the company has? In business, if the trade receivables is manageable, it is manageable and we should be able to sleep knowing that it is collectible within the credit timeframe. However, what happens when your total receivables are close to your last year's total revenue? This is the case with EA Holdings.

Look further on the trade receivables - a bad asset

Let's look further on its trade receivables in details. RM13 million of collectibles which is more than 120 days? Well, you may say that out of the RM30 million, around RM10.5 million is in the less than 30 days column. However, I can also ask for the entire year's revenue of RM36.6 million for 2011, at least RM10.5 million is registered in the final month? Are we saying that the company is registering at least 30% of the total revenue in the final month? They can claim that since the company is a project based company, their revenue can be lumpy. You have to convince me more than that.

Now, you know why it can be regarded as a bad asset? In this case, receivables may not seem to be as liquid as it seems. Sometimes, one may look at just the total current asset but imagine what if a large portion of the receivables is being placed on the cash and cash equivalents row rather. The total current assets remain the same but the liquidity of the company is much stronger.

Profit and Loss Statement below to show that its revenue for the year was RM36.6 million, Although it can register a nice profit of RM11.8 million, with this kind of balance sheet, is it justified?

You know what if you look further to its balance sheet for 31 March 2012, it has gone further worse.

EAH's Balance Sheet

Notice the remark side below. What consists of bad assets i.e. one which you do not want to have, as too much can be a bad thing. For EA below, you can assume that it reportedly has a Net Asset of RM55.5 million. Well, this is what it reports in its Annual Report but what it does not highlight in the chart section is that its intangible asset is RM24.7 million. Hence making its Net Tangible Asset at RM30.8 million. Not so great yeah since I have not heard of the company before and its intangible strength may not be of a Coca-cola or even Apple. How valuable are the intangibles really? If you look further, EA bought an IT company call DDSB Sdn Bhd in August 2010 for RM19.4 million and due to that purchase, close to RM18 million is consolidated as goodwill.

What other bad assets that the company has? In business, if the trade receivables is manageable, it is manageable and we should be able to sleep knowing that it is collectible within the credit timeframe. However, what happens when your total receivables are close to your last year's total revenue? This is the case with EA Holdings.

Look further on the trade receivables - a bad asset

Let's look further on its trade receivables in details. RM13 million of collectibles which is more than 120 days? Well, you may say that out of the RM30 million, around RM10.5 million is in the less than 30 days column. However, I can also ask for the entire year's revenue of RM36.6 million for 2011, at least RM10.5 million is registered in the final month? Are we saying that the company is registering at least 30% of the total revenue in the final month? They can claim that since the company is a project based company, their revenue can be lumpy. You have to convince me more than that.

Now, you know why it can be regarded as a bad asset? In this case, receivables may not seem to be as liquid as it seems. Sometimes, one may look at just the total current asset but imagine what if a large portion of the receivables is being placed on the cash and cash equivalents row rather. The total current assets remain the same but the liquidity of the company is much stronger.

Profit and Loss Statement below to show that its revenue for the year was RM36.6 million, Although it can register a nice profit of RM11.8 million, with this kind of balance sheet, is it justified?

You know what if you look further to its balance sheet for 31 March 2012, it has gone further worse.

Friday, March 2, 2012

EAH: What business takes a year to collect?

I read an article by a largely followed investment blogger introducing EA Holdings and complimenting its financial performance. I however feel he is overly optimistic.

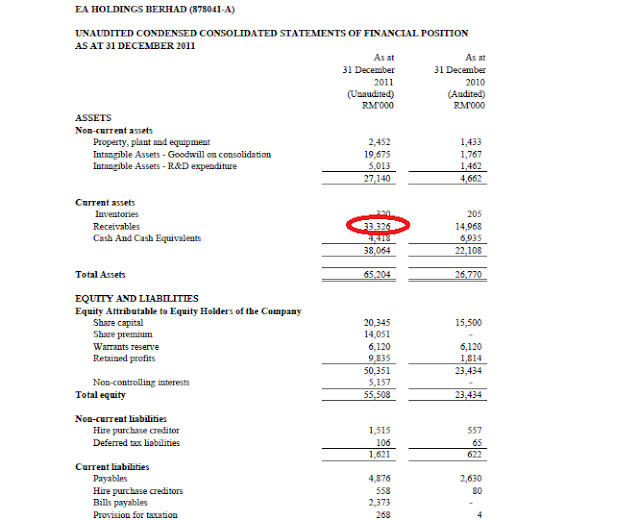

Look at the 2 numbers circled in red as below:

Revenue for the year - RM36,551,000

Total Receivables as at 31 Dec 2011 - RM33,326,000

Receivables turnover - 1.09 times (36,551 / 33,326)

Yes, Net Profit grew from RM4 million to RM11.76 million in FY2011. But what kind of business takes almost a year to collect? Is this a case of the company trying too hard to flip up to Main Board? At Market Capitalization of RM64 million, is this justified for a company who is soooo poor at collecting? Do they need to write off the receivables in years to come? Or is it just another case of the sales figure are not real?

Hmmm. remember Transmile! Or check out my other post on how do we know receivables numbers to be real.

Serious Investing!

Look at the 2 numbers circled in red as below:

Revenue for the year - RM36,551,000

Total Receivables as at 31 Dec 2011 - RM33,326,000

Receivables turnover - 1.09 times (36,551 / 33,326)

Yes, Net Profit grew from RM4 million to RM11.76 million in FY2011. But what kind of business takes almost a year to collect? Is this a case of the company trying too hard to flip up to Main Board? At Market Capitalization of RM64 million, is this justified for a company who is soooo poor at collecting? Do they need to write off the receivables in years to come? Or is it just another case of the sales figure are not real?

Hmmm. remember Transmile! Or check out my other post on how do we know receivables numbers to be real.

Serious Investing!

Subscribe to:

Posts (Atom)