Most investors are wary of Chinese red chips stocks. It has happened in US, Singapore and more recently Malaysia. We just do not trust the accounts and we do not know how to address that. The most recent case is China Stationery where the company had one worrying sign after another:

- change of auditor - last year where Grant Thornton Foo Kon Tan resigned - one big warning sign;

- fire to one of its factories - when times are bad, a fire would partly solve it as it would have erase a lot of records, if needed to;

- resignation of directors - 1 just resigned a fortnight ago; and

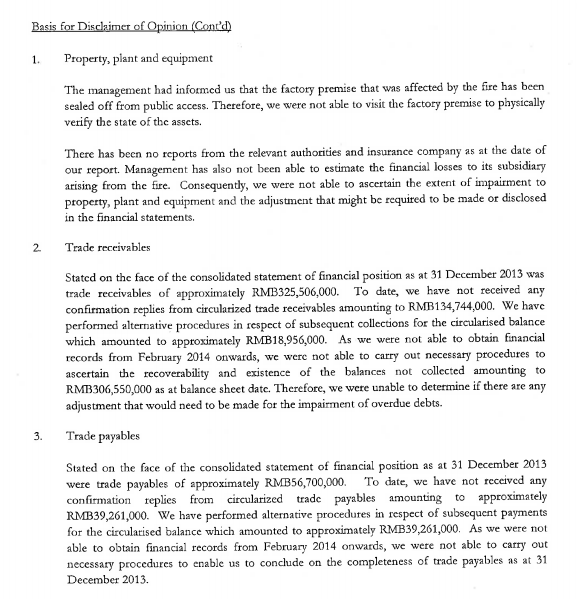

- auditor's disclaimer.

When an auditor disclaim its findings, we have to read what it disclaims - as below.

Ironically, it does not disclaim the cash position of the company, in which case it is very substantial. This also points to me that after having audited through the account, except for the items above that it disclaim or basically telling people it is unsure of, the cash position is verified. Below is part of its position of its balance sheet where it has RMB2.366 billion cash or RM1.2 billion. CSL's current traded value is RM124 million i.e. 10x below its cash holdings!

Did the fire burn any of those cash? Not possible as it would most definitely be in the bank.

Can we trust the bank statement? I don't know! As too many things have happened to the company until I do not know what to trust and that means, we have to take the accounts that the auditor signed-off as still questionable?

Showing posts with label China Stationery. Show all posts

Showing posts with label China Stationery. Show all posts

Wednesday, July 9, 2014

Sunday, July 28, 2013

Sales that does not makes sense

Do you notice anything that's fishy...

The company has more than RM0.80 of cash per share and very limited debt.

If the number is true, why would the shareholder sell? Why not capital distribution or dividend? Red chips stocks are really creating doubts if this persist. How do we trust the numbers or are they that naive to think that their shares are overvalued?

Monday, March 25, 2013

How do you smell a rat?

There are reasons why many would want to avoid Chinese stocks. In every few stocks, I am sure there are some decent ones but we just would not know which is good, and which is bad. By the way, all of them on paper looks decently good, in value. There are however stories of accounts and even cash balances are forged - I don't know how but just we have to be careful.

China Stationery is one of the Chinese stocks. Its accounts look good. It has a NTA of RM0.98 per share while the cash balance was at RM0.73 per share as at 31 Dec 2012. No debt. It however is trading at RM0.465. That looks very good? We are buying at substantially lower than cash holding - how fantastic is that?

Just last week, there was a transaction by the major shareholder selling 4.02% of his stocks and guess at what price? RM0.60. If I am the major shareholder, and in my bank balance, I have RM0.73 cash per share, I would not sell at RM0.60. That looks very stupid, isn't it? The sale of RM0.60 was to an unknown party, could be left pocket to right pocket. But yet it is no good. It is not at all transparent.

On top of that, the IPO a year ago was raised at RM0.95. Who again would sell, way below IPO price if on paper it is performing as in the financial accounts?

Anyway, who cares...there are just some people who would still be interested. Much stranger things have happened in Bursa and this is not it.

Subscribe to:

Posts (Atom)

+announcement.png)