Remember years ago when Telekom Malaysia (TM) had TM Touch? They were going nowhere and for TM to have a significant mobile business and successful one, the forced (sort of) purchase was planned. After the purchase of Celcom from Tajuddin Ramli, years later it was split again, presumably for Celcom and its mobile business to have a solid Asian strategy, hence Axiata.

TM on the other hand, was given a lot of handouts in the form of financial assistance for its fiber broadband rollout - to the tune of multi billions. With that handout, few would think that TM can fail. In fact when Celcom and other mobile businesses were split from TM, these mobile group was structured to owe TM something like RM4 billion, another assistance to TM.

TM should not and cannot fail, just like MAS. The difference between MAS and TM is that MAS is fighting globally competitive players. TM is given a headstart in any of the competition it goes into, something like standing on the 50 meters mark in a 100m race while the rest will have to start from the beginning.

Who will think TM will succeed in the mobile data business acquiring Green Packet? I don't.

In a standing start against players like Maxis, Celcom, Digi - it will pretty much lose, what more coming from behind although it has the backbone of fiber optics - something that the others lose out to TM.

In a business of telco, it is not just the infra. Tell that to Digi, which does lose out in infra - even for the LTE spectrum and it did not even have the 3G spectrum earlier - forced to a deal with Time Dotcom.

This deal does not help anybody but to postpone the demise of Green Packet while another player whom are not able turnaround anybody is thinking that it can. SK Telekom's name is just a convenient partner to bring the story line sounds better. After all, it has been with Green Packet for many years and nothing really happened.

Saturday, March 29, 2014

Thursday, March 20, 2014

EcoWorld's land purchase

EcoWorld has just announced a land purchase at RM35 per sq foot from Tropicana. That piece of land is adjacent to Bandar Rimbayu, now a IJM project with Keuro owning effectively 28% of that piece. The piece that is owned through Rimbayu is around 1,870 acres and that translate to 43,560 x 1,870 = 81,457,200 sq ft. Assuming we are taking at RM35 per sq ft as what EcoWorld is paying, the piece is worth around RM2.851 billion. This means Keuro's stake on the land alone is worth around RM798 million.

The Rimbayu's piece has a huge lake which although is a discount, will still be worth something. Buyers like houses overlooking a nice lake, which Rimbayu has.

Now you know why I was pissed off...

Note:

Keuro's effective stake in Bandar Rimbayu Sdn Bhd which is derived from 2013 Annual Report.

Another which shows that the effective ownership of Rimbayu (formerly known as Canal City Construction) is 28% and used to be 35% (Between financial year 2012 and 2013, there was no shareholding change for Rimbayu) is as below:

The Rimbayu's piece has a huge lake which although is a discount, will still be worth something. Buyers like houses overlooking a nice lake, which Rimbayu has.

Now you know why I was pissed off...

Note:

Keuro's effective stake in Bandar Rimbayu Sdn Bhd which is derived from 2013 Annual Report.

Another which shows that the effective ownership of Rimbayu (formerly known as Canal City Construction) is 28% and used to be 35% (Between financial year 2012 and 2013, there was no shareholding change for Rimbayu) is as below:

|

| From Annual Report 2012, the one provided under Annual Report 2013 is probably wrong |

Thursday, March 13, 2014

Large Jobstreet block sold

Last week, prior to the dividend cut off date, there was a single day when Jobstreet had a very large transaction. I was sort of expecting Fidelity to be selling and it was true that the large block of some 14 million shares in a day. Who has been buying is unknown as well as why Fidelity has been selling is also unknown.

The only thing that I am guessing is that since Fidelity owns a substantial block of Seek (as shown below), I would guess that it does not want to own as many stocks in Jobstreet during a period where it is critical to get shareholders approval for the deal. As it is, Seek already owns some 22.2% of Jobstreet, it does not help when Fidelity also owns a substantial block of the target. I am not sure if Fidelity is allowed to vote among the shareholders meeting although the submission papers does not mention that. Whatever is known is that for the deal to be approved, it will require 75% shareholders approval (with Seek abstain from voting). 75% is substantial.

The large chunk of Jobstreet's shares were sold at RM2.41 prior to dividend (ex-date 10 March). The parties whom bought the large block from Fidelity off market would have made a handsome gain over a short period of time if Jobstreet is worth more than RM2.60. That's how the rich makes money, I guess!

The only thing that I am guessing is that since Fidelity owns a substantial block of Seek (as shown below), I would guess that it does not want to own as many stocks in Jobstreet during a period where it is critical to get shareholders approval for the deal. As it is, Seek already owns some 22.2% of Jobstreet, it does not help when Fidelity also owns a substantial block of the target. I am not sure if Fidelity is allowed to vote among the shareholders meeting although the submission papers does not mention that. Whatever is known is that for the deal to be approved, it will require 75% shareholders approval (with Seek abstain from voting). 75% is substantial.

The large chunk of Jobstreet's shares were sold at RM2.41 prior to dividend (ex-date 10 March). The parties whom bought the large block from Fidelity off market would have made a handsome gain over a short period of time if Jobstreet is worth more than RM2.60. That's how the rich makes money, I guess!

|

| Fidelity's holding of Seek.com |

Tuesday, March 4, 2014

Where did it go wrong? (Pls read comments as well)

Sometimes in an investment, one should have some time to really look through in detail. Time was something I did not really have in the past month, but yet I did some investment - Jobstreet.

In any case, I have looked at the continued dwindling of Jobstreet, even after my purchase. It is now trading at RM2.41 (4 Mar 2014) - be prepared for it to drop further, it seems.

Only after the drop, I decided to read in more detail of the entire issue - this is a mistake, one should not do this! One should look and look, to be accurate, read again.

Anyway, this is what I have found - based on the information that is available.

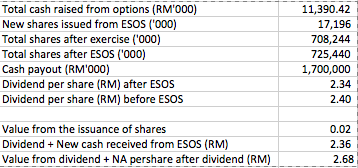

The above shows the ESOS that is outstanding as at 31 December 2013. That would add to the number of shares after new shares are issued to the minority shareholders which Jobstreet, the holding company does not own 100%. In the sale of its business, Jobstreet is doing an exercise and selling the business in its entirety - 100% of all the subsidiaries. Hence, it will need to issue new shares in exchange for the shares in Jobstreet Vietnam, Philippines and Indonesia it does not own. After the purchases, the total number of shares that are outstanding would have increased to 708,244.

However, this does not include the ESOS that can be exercised by the ESOS holders. Hence, I have done a simple calculation as below and try to explain at my level best.

What the above Table 3 depicts is that how many shares would be outstanding assuming that all the ESOS shares are exercised (which I think would be the case as the ESOS are all in the money).

How much dividend would be paid out per share after the full exercise of the ESOS? RM2.34.

However, as the ESOS would involve new cash being injected for the subscription, there would be a net addition of RM11.39 million of new cash from ESOS (first line of Table 3). That translates to RM0.02 per total shares (RM11,390 / 725,440) of Jobstreet.

Based on what's left after the dividend, assuming it gets the full value of its Net Asset Per share of around RM0.32 - RM0.33, the intrinsic value would be somewhere around RM2.68. (Note that I normally do not try to guess the intrinsic value of company except for this situation, which is possible)

I am trying to trust that the management would have concluded the sale by 2nd quarter of 2014 and that is some 4 months down the line at the most. With that, I am now thinking that the currently traded price has a decent what you call "Margin of Safety".

Note: Of course, I am not able to know how many new ESOS would be added between 1 Jan 2014 until now as that has never been revealed by the management of Jobstreet. Of all the good things, that the management of Jobstreet had done, this piece of information is not complete and it is forcing the shareholders to do their own calculation - not right!

Anyhow, I do not really care about the PN17 in this case as it is about the lack of strategic business than it in financial difficulties.

In any case, I have looked at the continued dwindling of Jobstreet, even after my purchase. It is now trading at RM2.41 (4 Mar 2014) - be prepared for it to drop further, it seems.

Only after the drop, I decided to read in more detail of the entire issue - this is a mistake, one should not do this! One should look and look, to be accurate, read again.

Anyway, this is what I have found - based on the information that is available.

The above shows the ESOS that is outstanding as at 31 December 2013. That would add to the number of shares after new shares are issued to the minority shareholders which Jobstreet, the holding company does not own 100%. In the sale of its business, Jobstreet is doing an exercise and selling the business in its entirety - 100% of all the subsidiaries. Hence, it will need to issue new shares in exchange for the shares in Jobstreet Vietnam, Philippines and Indonesia it does not own. After the purchases, the total number of shares that are outstanding would have increased to 708,244.

However, this does not include the ESOS that can be exercised by the ESOS holders. Hence, I have done a simple calculation as below and try to explain at my level best.

|

| Table 3 |

What the above Table 3 depicts is that how many shares would be outstanding assuming that all the ESOS shares are exercised (which I think would be the case as the ESOS are all in the money).

How much dividend would be paid out per share after the full exercise of the ESOS? RM2.34.

However, as the ESOS would involve new cash being injected for the subscription, there would be a net addition of RM11.39 million of new cash from ESOS (first line of Table 3). That translates to RM0.02 per total shares (RM11,390 / 725,440) of Jobstreet.

Based on what's left after the dividend, assuming it gets the full value of its Net Asset Per share of around RM0.32 - RM0.33, the intrinsic value would be somewhere around RM2.68. (Note that I normally do not try to guess the intrinsic value of company except for this situation, which is possible)

I am trying to trust that the management would have concluded the sale by 2nd quarter of 2014 and that is some 4 months down the line at the most. With that, I am now thinking that the currently traded price has a decent what you call "Margin of Safety".

Note: Of course, I am not able to know how many new ESOS would be added between 1 Jan 2014 until now as that has never been revealed by the management of Jobstreet. Of all the good things, that the management of Jobstreet had done, this piece of information is not complete and it is forcing the shareholders to do their own calculation - not right!

Anyhow, I do not really care about the PN17 in this case as it is about the lack of strategic business than it in financial difficulties.

Sunday, March 2, 2014

Warren Buffett's 2013 letter

It is usually that time of the period when I will gleefully read a very informative annual report and gain (or act as reminder) some lessons on investing. This year it is no difference - in fact, I felt that this time it the Warren Buffett's message is even better. If you do not have the time to read all (you should), I have picked up 2 pages of his thoughts as below (Although I am doing the easy work i.e. pulling out someone's else work, but I think it is a rather invigorating lesson):

************

Some Thoughts About Investing

Investment is most intelligent when it is most businesslike.

—The Intelligent Investor by Benjamin Graham

It is fitting to have a Ben Graham quote open this discussion because I owe so much of what I know about investing to him. I will talk more about Ben a bit later, and I will even sooner talk about common stocks. But let me first tell you about two small non-stock investments that I made long ago. Though neither changed my net worth by much, they are instructive.

This tale begins in Nebraska. From 1973 to 1981, the Midwest experienced an explosion in farm prices, caused by a widespread belief that runaway inflation was coming and fueled by the lending policies of small rural banks. Then the bubble burst, bringing price declines of 50% or more that devastated both leveraged farmers and their lenders. Five times as many Iowa and Nebraska banks failed in that bubble’s aftermath than in our recent Great Recession.

In 1986, I purchased a 400-acre farm, located 50 miles north of Omaha, from the FDIC. It cost me $280,000, considerably less than what a failed bank had lent against the farm a few years earlier. I knew nothing about operating a farm. But I have a son who loves farming and I learned from him both how many bushels of corn and soybeans the farm would produce and what the operating expenses would be. From these estimates, I calculated the normalized return from the farm to then be about 10%. I also thought it was likely that productivity would improve over time and that crop prices would move higher as well. Both expectations proved out.

I needed no unusual knowledge or intelligence to conclude that the investment had no downside and potentially had substantial upside. There would, of course, be the occasional bad crop and prices would sometimes disappoint. But so what? There would be some unusually good years as well, and I would never be under any pressure to sell the property. Now, 28 years later, the farm has tripled its earnings and is worth five times or more what I paid. I still know nothing about farming and recently made just my second visit to the farm.

In 1993, I made another small investment. Larry Silverstein, Salomon’s landlord when I was the company’s CEO, told me about a New York retail property adjacent to NYU that the Resolution Trust Corp. was selling. Again, a bubble had popped – this one involving commercial real estate – and the RTC had been created to dispose of the assets of failed savings institutions whose optimistic lending practices had fueled the folly.

Here, too, the analysis was simple. As had been the case with the farm, the unleveraged current yield from the property was about 10%. But the property had been undermanaged by the RTC, and its income would increase when several vacant stores were leased. Even more important, the largest tenant – who occupied around 20% of the project’s space – was paying rent of about $5 per foot, whereas other tenants averaged $70. The expiration of this bargain lease in nine years was certain to provide a major boost to earnings. The property’s location was also superb: NYU wasn’t going anywhere.

I joined a small group, including Larry and my friend Fred Rose, that purchased the parcel. Fred was an experienced, high-grade real estate investor who, with his family, would manage the property. And manage it they did. As old leases expired, earnings tripled. Annual distributions now exceed 35% of our original equity investment. Moreover, our original mortgage was refinanced in 1996 and again in 1999, moves that allowed several special distributions totaling more than 150% of what we had invested. I’ve yet to view the property. Income from both the farm and the NYU real estate will probably increase in the decades to come. Though the gains won’t be dramatic, the two investments will be solid and satisfactory holdings for my lifetime and, subsequently, for my children and grandchildren.

I tell these tales to illustrate certain fundamentals of investing:

- You don’t need to be an expert in order to achieve satisfactory investment returns. But if you aren’t, you must recognize your limitations and follow a course certain to work reasonably well. Keep things simple and don’t swing for the fences. When promised quick profits, respond with a quick “no.”

- Focus on the future productivity of the asset you are considering. If you don’t feel comfortable making a rough estimate of the asset’s future earnings, just forget it and move on. No one has the ability to evaluate every investment possibility. But omniscience isn’t necessary; you only need to understand the actions you undertake.

- If you instead focus on the prospective price change of a contemplated purchase, you are speculating. There is nothing improper about that. I know, however, that I am unable to speculate successfully, and I am skeptical of those who claim sustained success at doing so. Half of all coin-flippers will win their first toss; none of those winners has an expectation of profit if he continues to play the game. And the fact that a given asset has appreciated in the recent past is never a reason to buy it.

- With my two small investments, I thought only of what the properties would produce and cared not at all about their daily valuations. Games are won by players who focus on the playing field – not by those whose eyes are glued to the scoreboard. If you can enjoy Saturdays and Sundays without looking at stock prices, give it a try on weekdays.

- Forming macro opinions or listening to the macro or market predictions of others is a waste of time. Indeed, it is dangerous because it may blur your vision of the facts that are truly important. (When I hear TV commentators glibly opine on what the market will do next, I am reminded of Mickey Mantle’s scathing comment: “You don’t know how easy this game is until you get into that broadcasting booth.”)

My two purchases were made in 1986 and 1993. What the economy, interest rates, or the stock market might do in the years immediately following – 1987 and 1994 – was of no importance to me in making those investments. I can’t remember what the headlines or pundits were saying at the time. Whatever the chatter, corn would keep growing in Nebraska and students would flock to NYU.

There is one major difference between my two small investments and an investment in stocks. Stocks provide you minute-to-minute valuations for your holdings whereas I have yet to see a quotation for either my farm or the New York real estate.

It should be an enormous advantage for investors in stocks to have those wildly fluctuating valuations placed on their holdings – and for some investors, it is. After all, if a moody fellow with a farm bordering my property yelled out a price every day to me at which he would either buy my farm or sell me his – and those prices varied widely over short periods of time depending on his mental state – how in the world could I be other than benefited by his erratic behavior? If his daily shout-out was ridiculously low, and I had some spare cash, I would buy his farm. If the number he yelled was absurdly high, I could either sell to him or just go on farming.

Owners of stocks, however, too often let the capricious and often irrational behavior of their fellow owners cause them to behave irrationally as well. Because there is so much chatter about markets, the economy, interest rates, price behavior of stocks, etc., some investors believe it is important to listen to pundits – and, worse yet, important to consider acting upon their comments.

Those people who can sit quietly for decades when they own a farm or apartment house too often become frenetic when they are exposed to a stream of stock quotations and accompanying commentators delivering an implied message of “Don’t just sit there, do something.” For these investors, liquidity is transformed from the unqualified benefit it should be to a curse.

A “flash crash” or some other extreme market fluctuation can’t hurt an investor any more than an erratic and mouthy neighbor can hurt my farm investment. Indeed, tumbling markets can be helpful to the true investor if he has cash available when prices get far out of line with values. A climate of fear is your friend when investing; a euphoric world is your enemy.

During the extraordinary financial panic that occurred late in 2008, I never gave a thought to selling my farm or New York real estate, even though a severe recession was clearly brewing. And, if I had owned 100% of a solid business with good long-term prospects, it would have been foolish for me to even consider dumping it. So why would I have sold my stocks that were small participations in wonderful businesses? True, any one of them might eventually disappoint, but as a group they were certain to do well. Could anyone really believe the earth was going to swallow up the incredible productive assets and unlimited human ingenuity existing in America?

When Charlie and I buy stocks – which we think of as small portions of businesses – our analysis is very similar to that which we use in buying entire businesses. We first have to decide whether we can sensibly estimate an earnings range for five years out, or more. If the answer is yes, we will buy the stock (or business) if it sells at a reasonable price in relation to the bottom boundary of our estimate. If, however, we lack the ability to estimate future earnings – which is usually the case – we simply move on to other prospects. In the 54 years we have worked together, we have neverforegone an attractive purchase because of the macro or political environment, or the views of other people. In fact, these subjects never come up when we make decisions.

It’s vital, however, that we recognize the perimeter of our “circle of competence” and stay well inside of it. Even then, we will make some mistakes, both with stocks and businesses. But they will not be the disasters that occur, for example, when a long-rising market induces purchases that are based on anticipated price behavior and a desire to be where the action is.

************

Some Thoughts About Investing

Investment is most intelligent when it is most businesslike.

—The Intelligent Investor by Benjamin Graham

It is fitting to have a Ben Graham quote open this discussion because I owe so much of what I know about investing to him. I will talk more about Ben a bit later, and I will even sooner talk about common stocks. But let me first tell you about two small non-stock investments that I made long ago. Though neither changed my net worth by much, they are instructive.

This tale begins in Nebraska. From 1973 to 1981, the Midwest experienced an explosion in farm prices, caused by a widespread belief that runaway inflation was coming and fueled by the lending policies of small rural banks. Then the bubble burst, bringing price declines of 50% or more that devastated both leveraged farmers and their lenders. Five times as many Iowa and Nebraska banks failed in that bubble’s aftermath than in our recent Great Recession.

In 1986, I purchased a 400-acre farm, located 50 miles north of Omaha, from the FDIC. It cost me $280,000, considerably less than what a failed bank had lent against the farm a few years earlier. I knew nothing about operating a farm. But I have a son who loves farming and I learned from him both how many bushels of corn and soybeans the farm would produce and what the operating expenses would be. From these estimates, I calculated the normalized return from the farm to then be about 10%. I also thought it was likely that productivity would improve over time and that crop prices would move higher as well. Both expectations proved out.

I needed no unusual knowledge or intelligence to conclude that the investment had no downside and potentially had substantial upside. There would, of course, be the occasional bad crop and prices would sometimes disappoint. But so what? There would be some unusually good years as well, and I would never be under any pressure to sell the property. Now, 28 years later, the farm has tripled its earnings and is worth five times or more what I paid. I still know nothing about farming and recently made just my second visit to the farm.

In 1993, I made another small investment. Larry Silverstein, Salomon’s landlord when I was the company’s CEO, told me about a New York retail property adjacent to NYU that the Resolution Trust Corp. was selling. Again, a bubble had popped – this one involving commercial real estate – and the RTC had been created to dispose of the assets of failed savings institutions whose optimistic lending practices had fueled the folly.

Here, too, the analysis was simple. As had been the case with the farm, the unleveraged current yield from the property was about 10%. But the property had been undermanaged by the RTC, and its income would increase when several vacant stores were leased. Even more important, the largest tenant – who occupied around 20% of the project’s space – was paying rent of about $5 per foot, whereas other tenants averaged $70. The expiration of this bargain lease in nine years was certain to provide a major boost to earnings. The property’s location was also superb: NYU wasn’t going anywhere.

I joined a small group, including Larry and my friend Fred Rose, that purchased the parcel. Fred was an experienced, high-grade real estate investor who, with his family, would manage the property. And manage it they did. As old leases expired, earnings tripled. Annual distributions now exceed 35% of our original equity investment. Moreover, our original mortgage was refinanced in 1996 and again in 1999, moves that allowed several special distributions totaling more than 150% of what we had invested. I’ve yet to view the property. Income from both the farm and the NYU real estate will probably increase in the decades to come. Though the gains won’t be dramatic, the two investments will be solid and satisfactory holdings for my lifetime and, subsequently, for my children and grandchildren.

I tell these tales to illustrate certain fundamentals of investing:

- You don’t need to be an expert in order to achieve satisfactory investment returns. But if you aren’t, you must recognize your limitations and follow a course certain to work reasonably well. Keep things simple and don’t swing for the fences. When promised quick profits, respond with a quick “no.”

- Focus on the future productivity of the asset you are considering. If you don’t feel comfortable making a rough estimate of the asset’s future earnings, just forget it and move on. No one has the ability to evaluate every investment possibility. But omniscience isn’t necessary; you only need to understand the actions you undertake.

- If you instead focus on the prospective price change of a contemplated purchase, you are speculating. There is nothing improper about that. I know, however, that I am unable to speculate successfully, and I am skeptical of those who claim sustained success at doing so. Half of all coin-flippers will win their first toss; none of those winners has an expectation of profit if he continues to play the game. And the fact that a given asset has appreciated in the recent past is never a reason to buy it.

- With my two small investments, I thought only of what the properties would produce and cared not at all about their daily valuations. Games are won by players who focus on the playing field – not by those whose eyes are glued to the scoreboard. If you can enjoy Saturdays and Sundays without looking at stock prices, give it a try on weekdays.

- Forming macro opinions or listening to the macro or market predictions of others is a waste of time. Indeed, it is dangerous because it may blur your vision of the facts that are truly important. (When I hear TV commentators glibly opine on what the market will do next, I am reminded of Mickey Mantle’s scathing comment: “You don’t know how easy this game is until you get into that broadcasting booth.”)

My two purchases were made in 1986 and 1993. What the economy, interest rates, or the stock market might do in the years immediately following – 1987 and 1994 – was of no importance to me in making those investments. I can’t remember what the headlines or pundits were saying at the time. Whatever the chatter, corn would keep growing in Nebraska and students would flock to NYU.

There is one major difference between my two small investments and an investment in stocks. Stocks provide you minute-to-minute valuations for your holdings whereas I have yet to see a quotation for either my farm or the New York real estate.

It should be an enormous advantage for investors in stocks to have those wildly fluctuating valuations placed on their holdings – and for some investors, it is. After all, if a moody fellow with a farm bordering my property yelled out a price every day to me at which he would either buy my farm or sell me his – and those prices varied widely over short periods of time depending on his mental state – how in the world could I be other than benefited by his erratic behavior? If his daily shout-out was ridiculously low, and I had some spare cash, I would buy his farm. If the number he yelled was absurdly high, I could either sell to him or just go on farming.

Owners of stocks, however, too often let the capricious and often irrational behavior of their fellow owners cause them to behave irrationally as well. Because there is so much chatter about markets, the economy, interest rates, price behavior of stocks, etc., some investors believe it is important to listen to pundits – and, worse yet, important to consider acting upon their comments.

Those people who can sit quietly for decades when they own a farm or apartment house too often become frenetic when they are exposed to a stream of stock quotations and accompanying commentators delivering an implied message of “Don’t just sit there, do something.” For these investors, liquidity is transformed from the unqualified benefit it should be to a curse.

A “flash crash” or some other extreme market fluctuation can’t hurt an investor any more than an erratic and mouthy neighbor can hurt my farm investment. Indeed, tumbling markets can be helpful to the true investor if he has cash available when prices get far out of line with values. A climate of fear is your friend when investing; a euphoric world is your enemy.

During the extraordinary financial panic that occurred late in 2008, I never gave a thought to selling my farm or New York real estate, even though a severe recession was clearly brewing. And, if I had owned 100% of a solid business with good long-term prospects, it would have been foolish for me to even consider dumping it. So why would I have sold my stocks that were small participations in wonderful businesses? True, any one of them might eventually disappoint, but as a group they were certain to do well. Could anyone really believe the earth was going to swallow up the incredible productive assets and unlimited human ingenuity existing in America?

************

When Charlie and I buy stocks – which we think of as small portions of businesses – our analysis is very similar to that which we use in buying entire businesses. We first have to decide whether we can sensibly estimate an earnings range for five years out, or more. If the answer is yes, we will buy the stock (or business) if it sells at a reasonable price in relation to the bottom boundary of our estimate. If, however, we lack the ability to estimate future earnings – which is usually the case – we simply move on to other prospects. In the 54 years we have worked together, we have neverforegone an attractive purchase because of the macro or political environment, or the views of other people. In fact, these subjects never come up when we make decisions.

It’s vital, however, that we recognize the perimeter of our “circle of competence” and stay well inside of it. Even then, we will make some mistakes, both with stocks and businesses. But they will not be the disasters that occur, for example, when a long-rising market induces purchases that are based on anticipated price behavior and a desire to be where the action is.

Subscribe to:

Posts (Atom)