Just to highlight how confident the principal officers are on IHH's shares. They are insiders who work for the IHH group.

Tan See Haw - Group CFO of Parkway (Singapore)

Transfer of 450,000 units (25 Jul which was the first day of trading)

Lee Swee Hee - CEO of Pantai Group's operations in Malaysia

Now the question is whether IHH are being supported by EPF and other government controlled bodies so that it is being listed at such a high price? Are you confident now?

Coincidentally these are people of financial background who were selling.

Monday, July 30, 2012

Saturday, July 28, 2012

IHH, KPJ, Sime Darby: Why listing healthcare is such a dangerous thing

Greed is good. Or is it?

Have you heard of these rumblings before? A simple procedure may cost us RM10,000. Delivering a baby may cost you more than RM10,000 in total. A son who faced with his passing father is slapped with total hospital bill of more than RM100,000 in the process of trying to save his dying father. The hospital would not let go of the body until all the outstanding bills are cleared. How ridiculous, but it is happening.

There is no doubt that these are charges which are the results of greedy hospitals and some medical practitioners - taking advantage of people who need healthcare assistance. Are these charges called for? Yes, we may say there is public hospital as an option.

But see this...

IHH is controlled by Khazanah, KPJ by Johor Corp and Sime Darby which is going strong on expanding its healthcare portfolio is owned by ASB / PNB. These are all states corporations and the hospitals they own are the largest hospital groups in the country. Are these government who owns the states corporation for the public or for the profits, you may wonder?

IHH for example, registered at most RM400 million last year as a group (inclusive of the Turkey's subsidiary - Acibadem group) This year, they sort of promised RM800 million. Double the profits? For a group which already has such long presence, what do you think they will do to register such profit growth? Either they already would have to double their presence (hospital beds) over such short period of time or do the unethical - increase their charges inconsiderately! Do you think within less than a year they would be able to increase their total visiting patients to high double digit percentage. No! They probably are not even able to increase their occupancy (per hospital). (Do you see these numbers reported in the Annual Report or Prospectus? No, I have yet to see them)

The most important number I want to see is the Average Revenue per Patient which I am not able to see. Why? They do not want to let us see how ridiculous this stats are - how much these numbers increase year on year. IHH has no choice but to reach the RM700 - RM800 million profit benchmark this year, as it is now they are being valued at more than RM25 billion (i.e. more than 60x historical PE). If they don't a much higher bottomline, it would be a disaster as investors would be claiming that they are over promising.

As the government, what would you do if the private hospitals increase their rates exorbitantly? Control these hospitals from increasing their rates? I do not see that. Adding to that, doctors are now asking for allowance to increase their fees. Don't you feel surprise that the doctors themselves are claiming the high charges all the while are due mainly to the hospitals, Managed Care Organizations and insurance companies?

Now, I feel that the government has no choice but to allow the doctors to increase their fees, otherwise this most important part of the chain is going to do a silent boycott (or the least, voice out their displeasures)! Imagine what can happen when the doctors are unhappy.

In increasing profits, another way to achieve that is by reducing costs - even this is dangerous don't you think as reducing costs could as well be reducing the number of staffs per patient or not increasing their wages proportionately to the increase in revenue. Mind you, these are all dangerous, and I can see it coming.

At a time when during the most critical of economic times, Barack Obama's administration is trying to solve the healthcare issues (which has been running for decades) of his country, we are embracing our ownership of this potentially catastrophic idea - celebrating private ownership of healthcare.

Could we have moved onto the wrong direction?

I am not against private healthcare but over-concentration in getting the numbers may be a really bad thing.

Have you heard of these rumblings before? A simple procedure may cost us RM10,000. Delivering a baby may cost you more than RM10,000 in total. A son who faced with his passing father is slapped with total hospital bill of more than RM100,000 in the process of trying to save his dying father. The hospital would not let go of the body until all the outstanding bills are cleared. How ridiculous, but it is happening.

There is no doubt that these are charges which are the results of greedy hospitals and some medical practitioners - taking advantage of people who need healthcare assistance. Are these charges called for? Yes, we may say there is public hospital as an option.

But see this...

IHH is controlled by Khazanah, KPJ by Johor Corp and Sime Darby which is going strong on expanding its healthcare portfolio is owned by ASB / PNB. These are all states corporations and the hospitals they own are the largest hospital groups in the country. Are these government who owns the states corporation for the public or for the profits, you may wonder?

IHH for example, registered at most RM400 million last year as a group (inclusive of the Turkey's subsidiary - Acibadem group) This year, they sort of promised RM800 million. Double the profits? For a group which already has such long presence, what do you think they will do to register such profit growth? Either they already would have to double their presence (hospital beds) over such short period of time or do the unethical - increase their charges inconsiderately! Do you think within less than a year they would be able to increase their total visiting patients to high double digit percentage. No! They probably are not even able to increase their occupancy (per hospital). (Do you see these numbers reported in the Annual Report or Prospectus? No, I have yet to see them)

The most important number I want to see is the Average Revenue per Patient which I am not able to see. Why? They do not want to let us see how ridiculous this stats are - how much these numbers increase year on year. IHH has no choice but to reach the RM700 - RM800 million profit benchmark this year, as it is now they are being valued at more than RM25 billion (i.e. more than 60x historical PE). If they don't a much higher bottomline, it would be a disaster as investors would be claiming that they are over promising.

As the government, what would you do if the private hospitals increase their rates exorbitantly? Control these hospitals from increasing their rates? I do not see that. Adding to that, doctors are now asking for allowance to increase their fees. Don't you feel surprise that the doctors themselves are claiming the high charges all the while are due mainly to the hospitals, Managed Care Organizations and insurance companies?

Now, I feel that the government has no choice but to allow the doctors to increase their fees, otherwise this most important part of the chain is going to do a silent boycott (or the least, voice out their displeasures)! Imagine what can happen when the doctors are unhappy.

In increasing profits, another way to achieve that is by reducing costs - even this is dangerous don't you think as reducing costs could as well be reducing the number of staffs per patient or not increasing their wages proportionately to the increase in revenue. Mind you, these are all dangerous, and I can see it coming.

At a time when during the most critical of economic times, Barack Obama's administration is trying to solve the healthcare issues (which has been running for decades) of his country, we are embracing our ownership of this potentially catastrophic idea - celebrating private ownership of healthcare.

Could we have moved onto the wrong direction?

I am not against private healthcare but over-concentration in getting the numbers may be a really bad thing.

Thursday, July 26, 2012

If you want to pit your trading skill, pit against this man!

Not Vincent Tan, not Syed Mokhtar as these guys are not traders. Check this out.

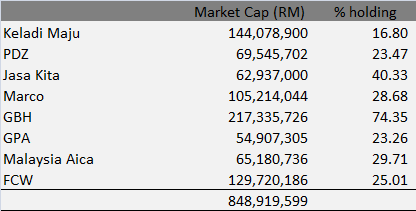

He controls a total 8 companies BUT with a combined market capitalisation of less than RM1 billion. Maybe in fact even more counters, which I may have lost track of. Anyone heard of these counters? All Main Board though. Collecting SMALL USELESS counters is a HOBBY (except for GBH).

Why so many but yet so small? So that he can trade against you. Look at the list of companies. Officially, he does not even own more than 40% on any of the companies he controls except for GBH. But try buying those counters.

These companies are not at all exciting. Minimal profit, if any. Hence, minimal dividend as well, again if any.

Then why bother buying these companies - only for the traders or speculators. But I am willing to bet he will beat most of us hands down. His companies are all zero sum game - maybe even negative sum as he wins we lose.

Why? He has most information at hand. He knows who are the ones who have the power to hold for longer period, who cannot. Eventually, these so called long term holders can't hold on for long anyway, as they do not gain anything from these shares. Most who hold his counters are those who got caught. He likes it that way actually.

Also, he can bet big, we can't. He has cash, we have little. On paper, he already wins.

He is not bothered to build the business of these companies, ONLY for the traders.

So, who is he?

ROBERT TAN (TAN SRI) - not the IGB one ya!

Check him out. Mind you, he does not understand what I write, as he does not read English, but yet thousand times richer - than me. Now you know why I am not a trader.

|

| As at 25 Jul 2012 |

He controls a total 8 companies BUT with a combined market capitalisation of less than RM1 billion. Maybe in fact even more counters, which I may have lost track of. Anyone heard of these counters? All Main Board though. Collecting SMALL USELESS counters is a HOBBY (except for GBH).

Why so many but yet so small? So that he can trade against you. Look at the list of companies. Officially, he does not even own more than 40% on any of the companies he controls except for GBH. But try buying those counters.

These companies are not at all exciting. Minimal profit, if any. Hence, minimal dividend as well, again if any.

Then why bother buying these companies - only for the traders or speculators. But I am willing to bet he will beat most of us hands down. His companies are all zero sum game - maybe even negative sum as he wins we lose.

Why? He has most information at hand. He knows who are the ones who have the power to hold for longer period, who cannot. Eventually, these so called long term holders can't hold on for long anyway, as they do not gain anything from these shares. Most who hold his counters are those who got caught. He likes it that way actually.

Also, he can bet big, we can't. He has cash, we have little. On paper, he already wins.

He is not bothered to build the business of these companies, ONLY for the traders.

So, who is he?

ROBERT TAN (TAN SRI) - not the IGB one ya!

Check him out. Mind you, he does not understand what I write, as he does not read English, but yet thousand times richer - than me. Now you know why I am not a trader.

Airasia acquiring Batavia Air - see what I meant

Airasia is acquiring 49% of Batavia Air while the remaining 51% is acquired by its Indonesian partner. I have mentioned that it is looking at Indonesia as the base for growth and in fact this deal is even better, accelerating further the growth of Airasia as a group.

See announcements below.

----------------------------------------------------------------------------------------------------

If anyone is holding any airline stocks in the region be it SIA, MAS, Cathay Pacific, Qantas etc, do change your holding as this Malaysian company is moving mountains. The larger premium airlines should be very afraid as the future of airline business is in low costs not your premium business seats!

Do not even bother about looking at the acquisition price they are paying for, as there is no point comparing someone so flexible who can bend, squat, run, hide while the other national airlines can only sit and watch. There is no competition in the future when comes to a company which can do deals with anyone overseas. Against these players, Airasia is just competing on a different rule. The deal is just an example on how fast they can get things done. National airlines would have it much more difficult.

This is the real Airasia as it no longer is a Malaysian based airline.

See announcements below.

----------------------------------------------------------------------------------------------------

AirAsia

Accelerates Indonesian Expansion Plans

AirAsia and PT Fersindo Nusaperkasa acquire Batavia Air

Thursday, 26 July 2012 for immediate release

Jakarta, Indonesia: AirAsia Berhad

(“AAB”) today announced that it has through its fully owned subsidiary AirAsia

Investment Ltd entered into a Conditional Share Sale Agreement

("CSSA") together with its partner PT Fersindo Nusaperkasa (“Fersindo”)

to acquire PT Metro Batavia (“Metro Batavia”), which operates the Indonesian

airline, Batavia Air, and Aero Flyer Institute (“AFI”), an aviation training

school (together “Metro Batavia Group”). The agreement was signed today between

AAB, Fersindo and Metro Batavia at a signing ceremony in Jakarta.

In accordance with Indonesian

civil aviation ownership regulations, AAB will hold a 49% stake in Metro

Batavia Group with the 51% majority held by its Indonesian partner, Fersindo.

Fersindo is also the 51% majority shareholder of PT Indonesia AirAsia (“IAA”). The

total purchasing consideration for Metro Batavia Group is USD80 million

(equivalent to approximately RM253 million) and will be settled in cash. The

acquisition of 100% interest in Metro Batavia by AAB and Fersindo will be

carried out in two stages, through acquisition of a majority 76.95% stake and

subsequently followed by the remaining 23.05% held by its existing

shareholders.

Correspondingly, the total

purchasing consideration for 100% interest in AFI is USD1 million

(approximately RM3.2 million). The acquisition is expected to complete by 2nd quarter 2013 and

is subject to regulatory approvals in Indonesia.

This new acquisition will

complement AirAsia’s existing Indonesian operations, IAA, which has

successfully captured strong market share in Indonesia’s international airline traffic,

with an extensive and well-established domestic route network throughout the Indonesian

archipelago. The Batavia Air acquisition provides greater domestic connectivity

and an extensive feeder network into IAA’s existing hubs in Jakarta, Bandung,

Denpasar, Medan and Surabaya. Upon the successful acquisition, Batavia Air and

IAA will fly more than 14 million customers serving 42 Indonesian

and

12 international destinations. The addition of Batavia Air will provide AirAsia

immediate access to an enlarged fleet of aircraft, experienced pilots and

flight crew and increasingly competitive slots at major Indonesian airports at

a time when Indonesia’s travel sector is experiencing double-digit growth on

the back of rapidly growing consumer demand for air travel.

Following the acquisition the

number of distribution channels in Indonesia will increase ten-fold to over

5000 authorised agents and more than 70 sales outlets. With this enlarged

agency footprint AirAsia will be able to reach even more customers while complementing

our internet based sales. “The Batavia Air acquisition is a fantastic

opportunity for AirAsia to accelerate our growth plans in one of the most exciting

aviation markets in Asia and further underlines our belief in the growth

potential of Indonesia’s aviation sector,” said Tan Sri Dr Tony Fernandes,

Group CEO and Director of AAB.

Founded in 2002, Batavia Air has

earned its reputation as a leading domestic airline with a strong safety track

record throughout its operating history. Operating a fleet of 33 aircraft,

Batavia has consistently held significant domestic market share through serving

41 domestic routes and has recently expanded its route network to international

destinations such as Singapore, Jeddah, Riyadh, Kuching, Dili and Guangzhou. A certified

flight school, simulator training centre and aircraft maintenance facilities

also support Batavia Air’s operations.

“I am proud to have built Batavia

Air into a leading Indonesian airline from its humble beginnings. Recent

developments in the airline industry have made me recognise that Batavia Air

requires greater scale in order to compete and grow further, and I am so pleased

that AirAsia will now take Batavia Air to even greater heights,” said Bapak Yudiawan

Tansari, Batavia Air’s founder.

“We are impressed with Batavia Air’s

achievements over the past 10 years and will continue to build on Bapak

Yudiawan’s legacy. We are excited with the potential synergies this acquisition

will bring to AirAsia Group and see this as a natural extension of the success

we have achieved with IAA . Indonesian air travelers can all look forward to

even more affordable fares soon,” remarked Tan’ Sri Dr Tony Fernandes.

Wednesday, July 25, 2012

Slashing car taxes may even help the country

Every time I was reading on affordability index on cars in US, their basic rule is not to buy a car which is more than 6 months a person's income. If that man's income per month is USD4,000, he can afford a Camry based on what that index is saying.

If I want to calculate based on Malaysian income per capita which we are at the current number of RM28,000, we're way off the chart - of course we are comparing against US here. A new MyVI (please, don't mention foreign brands to me) already costs something like RM50 - RM55k - Two years average income per capita, that is.

Now the idea of slashing car taxes is going to be a very popular idea for sure, but can we do it as it may affect government's revenue, some may say. I do not think we can model this until the actual implementation is taking place, but Think along these lines:

But we know for sure that for more than 25 years we have really suffered under the protect "local cars" scheme. I am just giving up as you know who is being protected - yet again!

If I want to calculate based on Malaysian income per capita which we are at the current number of RM28,000, we're way off the chart - of course we are comparing against US here. A new MyVI (please, don't mention foreign brands to me) already costs something like RM50 - RM55k - Two years average income per capita, that is.

Now the idea of slashing car taxes is going to be a very popular idea for sure, but can we do it as it may affect government's revenue, some may say. I do not think we can model this until the actual implementation is taking place, but Think along these lines:

- There's a higher turnover for new cars, hence the absolute amount of earned taxes may not reduce by that far. Government do not earn (much) from the second hand market. If cars are affordable to more people, perhaps (I am sure) there are a smaller market for second hand cars and definitely a larger market for new car sales. Car scrapping industry may just be kick-started;

- Disposable income will definitely improve - imagine the wonders that can happen from here - nothing beats giving money to the people on the streets in terms of recycling the cash;

- More cars sold means more income to the sales people, distributors - again more money to people on the streets;

- Less breakdown on the roads, and perhaps even lesser jams. Some may say more cars means more jams - think again;

- More cars means more pollution, yes - but I did not recommend reduction of tolls. In fact, more new cars may mean less pollution per car;

- I have to really promote reduction of subsidies for petrol though as this is not right;

- Other means of taxes on cars: road tax, automotive components maybe hence government may not lose much here;

- Lesser APs means lesser illicit monies transferred out of the country??? Hello! APs are never right ok, so is illicit money transfer;

- A more dynamic automotive industry in Malaysia - imagine what can really happen here.

But we know for sure that for more than 25 years we have really suffered under the protect "local cars" scheme. I am just giving up as you know who is being protected - yet again!

Tuesday, July 24, 2012

Some commentaries from ICapital - quite interesting

Was looking through ICap's 4th quarter report - quite interesting comment. Read below:

Meanwhile, ICap continues to hold RM134 million in cash. Between 29 Feb and 31 May 2012 there were no trades. So bloody easy their job, they would just stick to long term investment and call. Remember the saying, "It is much harder to find good stocks than finding bad ones."

The sale in most recent financial year was probably some units sale of F&N's shares, I believe.

It seems that the European economic calamities is causing havoc to the entire world. Yesterday's market in NYSE / Nasdaq and Europe were pretty precarious and it does not help when John Paulson predicted a 50% chance that Euro will collapse!

Meanwhile, ICap continues to hold RM134 million in cash. Between 29 Feb and 31 May 2012 there were no trades. So bloody easy their job, they would just stick to long term investment and call. Remember the saying, "It is much harder to find good stocks than finding bad ones."

The sale in most recent financial year was probably some units sale of F&N's shares, I believe.

It seems that the European economic calamities is causing havoc to the entire world. Yesterday's market in NYSE / Nasdaq and Europe were pretty precarious and it does not help when John Paulson predicted a 50% chance that Euro will collapse!

Oldtown: Insider Trading is not something you should do a lot!

Oldtown has created a brand for itself. Although I like the company until I have purchased some of its shares, the recent action of buying and selling is not something which I like.

See below.

Of course there are many companies who do this, but most of them have no business that are decent enough for them to concentrate on building. Oldtown has, at least I think so!

Now the transactions above are peanuts, and I do not believe that you are selling these for the sake of cashing out as the recent RM0.04 dividend which you have received, easily could have net more than RM6 million AND should be more than enough for you to not needing to transact the shares (IN SUCH SMALL VOLUME). I believe these are to show that you are cashing out at a price so that speculators believe at this price your share is overly expensive and this is to allow yourself and the rest to move in at a lower price.

But remember, you are the face of Oldtown and it is not the right thing to do as it will just create non-confidence to the management or owner majority shareholder.

Although you may say I am angry which I am not as I have experienced this often enough but being a listed company, you do not want to create suspicion in your handling of your company. As it is there are quite a lot of inter-company trades in your balance sheet!

As a company which has done so much, you should concentrate on building the company and brand and not too concern on how people will second-guess your action in the share market.

See below.

|

| Bought shares at RM0.90 and RM0.92 |

|

| Sold small quantities at RM2.03 and RM2.04 |

Now the transactions above are peanuts, and I do not believe that you are selling these for the sake of cashing out as the recent RM0.04 dividend which you have received, easily could have net more than RM6 million AND should be more than enough for you to not needing to transact the shares (IN SUCH SMALL VOLUME). I believe these are to show that you are cashing out at a price so that speculators believe at this price your share is overly expensive and this is to allow yourself and the rest to move in at a lower price.

But remember, you are the face of Oldtown and it is not the right thing to do as it will just create non-confidence to the management or owner majority shareholder.

Although you may say I am angry which I am not as I have experienced this often enough but being a listed company, you do not want to create suspicion in your handling of your company. As it is there are quite a lot of inter-company trades in your balance sheet!

As a company which has done so much, you should concentrate on building the company and brand and not too concern on how people will second-guess your action in the share market.

Monday, July 23, 2012

Do you think now is the right time to buy Top Glove?

It is no surprise that Top Glove has high ambitions as it has been proven in their past records. It is mentioned in the article by EdgeDaily that this largest glove manufacturer is planning to triple its production capacities over the next 15 years while planning to increase its global market share to 50%. Doable? A bit overoptimistic I would think but it is not an impossible task.

I have mentioned in the past that if we want to buy glove manufacturers, one may not need to look beyond Top Glove and Hartalega. My reasoning is simple. In a mature industry which has decent growth, look for company that has size, strong balance sheet, reach and ability to scale. Both Top Glove and Hartalega have that. I am not discounting other players like Supermax, Kossan, Latexx Partners etc. but chances are that the dominance would probably be by the 2 companies. Only thing is that we do not know latex gloves or nitrile gloves would be the preference. The way I look at it industry players themselves do not know as they are preparing production lines that are switchable.

Anyway, over the last 6 months, prices of latex has tapered down as it was over speculated few years ago. At one point of time the price was so high that costs of production for latex gloves was higher than nitrile gloves, an unprecedented event. We will not know the future of these raw material however, but I believe these players would be more ready in future in the event any of the raw material shot up in price again.

With the recent price of raw latex reducing to below RM7 per kg, I am just wondering whether it is time to buy Top Glove again. Prices of these raw material however should not be a consideration for any long term investors. The main concern is the strategy.

Over time, it may not be the prices of latex or petroleum that is to cause concerns to these players but what I am more concern of is whether there can be a glut in terms of supplies as well as the increasing labor costs. Hence, these players will have to convert their plant to embrace automation much more than before as Malaysia and Thailand are introducing minimum wages almost at the same time.

On the concern for glut in supplies of rubber gloves, I am just worried as every time I read about the industry news, these players are preparing themselves for massive expansion. Can the demand be taking so much?

I have mentioned in the past that if we want to buy glove manufacturers, one may not need to look beyond Top Glove and Hartalega. My reasoning is simple. In a mature industry which has decent growth, look for company that has size, strong balance sheet, reach and ability to scale. Both Top Glove and Hartalega have that. I am not discounting other players like Supermax, Kossan, Latexx Partners etc. but chances are that the dominance would probably be by the 2 companies. Only thing is that we do not know latex gloves or nitrile gloves would be the preference. The way I look at it industry players themselves do not know as they are preparing production lines that are switchable.

Anyway, over the last 6 months, prices of latex has tapered down as it was over speculated few years ago. At one point of time the price was so high that costs of production for latex gloves was higher than nitrile gloves, an unprecedented event. We will not know the future of these raw material however, but I believe these players would be more ready in future in the event any of the raw material shot up in price again.

With the recent price of raw latex reducing to below RM7 per kg, I am just wondering whether it is time to buy Top Glove again. Prices of these raw material however should not be a consideration for any long term investors. The main concern is the strategy.

Over time, it may not be the prices of latex or petroleum that is to cause concerns to these players but what I am more concern of is whether there can be a glut in terms of supplies as well as the increasing labor costs. Hence, these players will have to convert their plant to embrace automation much more than before as Malaysia and Thailand are introducing minimum wages almost at the same time.

On the concern for glut in supplies of rubber gloves, I am just worried as every time I read about the industry news, these players are preparing themselves for massive expansion. Can the demand be taking so much?

Saturday, July 21, 2012

What are intangibles?

Perhaps one of the biggest factor for investment decisions but yet not many have valued the significance of it. A lot of times it is much easier to calculate a business based on its Net Asset Value or if the business has significant goodwill, Net Tangible Assets. Remember I was highlighting Maxis which is trading at negative NTA but yet the valuation it gets is way higher than that.

Intangibles is brand value

For example, BAT is having Net Asset per share of below RM2 whereas its share price is trading at RM58 per share. Besides the manufacturing plant, distribution channel, management, the bulk of it is in its brand value. A lot of money have been spent on advertising for the brand and these costs are usually expensed off. However these branding enhancement spending, most of the time will not go to waste.

While PE ratio is historical, the brand value is what carries the business valuation to the future. PE and its profit trend is what guides us towards the valuation of the company but really the brand intangibles is what we are buying for especially for companies that has very little tangible asset value.

Intangibles is your perceived value on the company

For a company which has yet to make any profit - example Groupon, the market was valuing it at beyond $12billion at its IPO (now has dropped to below $5 billion). Few years ago Google was offering the shareholders of Groupon for somewhere around $6 billion. Hence it is the perceived value which we think the business value should be. Amazon is currently trading at 187x PE. Why? Because investors have so much confidence on this largest online retailer especially on its intangibles. They think Amazon will conquer online retailing so much so that the value that they are giving to Amazon is perhaps illogical for value investors.

Intangibles is where Property asset owned by a non-property company is very different from a premium property player

The land that Tan Chong Motor holds is valued differently to the land that say SP Setia or Sunrise may own even though it may be the same piece. Believe me on this? If Tan Chong or F&N Malaysia (which it is) becomes a property player, its valuation as a developer will be different from SP Setia or Sunrise or even IGB the developer. Hence, if Tan Chong is to develop on its Segambut land, its net sellable value may be lower than if Sunrise is to develop it.

Often in an analysis that I have read, the analysts would have calculated the properties based on the market value of the land but I sometimes disagree. For example, a piece of land in Klang which was valued at less than RM10 per sq ft can be turned into more than RM100 / sq ft by SP Setia within less than 10 years. Land adjacent to Setia Alam or Setia Eco Park do not carry the same valuation as the one owned by SP Setia. So if you want to buy properties, buy a property company which has a strong perceived brand value. If you disagree, do buy Talam (or Trinity) as they are trading at below NTA. If you noticed, even after Talam has changed name the perceived intangibles of the company is still low.

Negative intangibles is when consumer has negative perception of the company or the brand

Think of Proton. Proton has lost so much value that before it was delisted it was trading at below it NA. Why? Was it undervalued? You may think so now, but why not buy the shares during then? So a brand can have negative value - which is also why whenever there were rumours of Volkswagen or GM taking over the operations of Proton, its share price jumped.

Intangibles is the value we put onto the management and owner

Sometimes management can make a change to the value of the company instantaneously. Remember Steve Jobs and Apple? Most of the times however, it may not create much impact.

In Malaysia, I feel that recently there is a tendency to provide higher valuation to professionally managed companies (especially well managed ones) rather than owner managed companies. I may not know the exact reasons for it but it may go to trust as there are fear of owners who are management themselves influencing the share price or perhaps taken some questionable actions as I have highlighted in Digistar.

Can you see the significance of that value creation as it takes a whole effort to build it? Hence investment is not just Price / NA or PE as there are much more in intangibles to the whole lot effort to valuation.

Intangibles is brand value

For example, BAT is having Net Asset per share of below RM2 whereas its share price is trading at RM58 per share. Besides the manufacturing plant, distribution channel, management, the bulk of it is in its brand value. A lot of money have been spent on advertising for the brand and these costs are usually expensed off. However these branding enhancement spending, most of the time will not go to waste.

While PE ratio is historical, the brand value is what carries the business valuation to the future. PE and its profit trend is what guides us towards the valuation of the company but really the brand intangibles is what we are buying for especially for companies that has very little tangible asset value.

Intangibles is your perceived value on the company

For a company which has yet to make any profit - example Groupon, the market was valuing it at beyond $12billion at its IPO (now has dropped to below $5 billion). Few years ago Google was offering the shareholders of Groupon for somewhere around $6 billion. Hence it is the perceived value which we think the business value should be. Amazon is currently trading at 187x PE. Why? Because investors have so much confidence on this largest online retailer especially on its intangibles. They think Amazon will conquer online retailing so much so that the value that they are giving to Amazon is perhaps illogical for value investors.

Intangibles is where Property asset owned by a non-property company is very different from a premium property player

The land that Tan Chong Motor holds is valued differently to the land that say SP Setia or Sunrise may own even though it may be the same piece. Believe me on this? If Tan Chong or F&N Malaysia (which it is) becomes a property player, its valuation as a developer will be different from SP Setia or Sunrise or even IGB the developer. Hence, if Tan Chong is to develop on its Segambut land, its net sellable value may be lower than if Sunrise is to develop it.

Often in an analysis that I have read, the analysts would have calculated the properties based on the market value of the land but I sometimes disagree. For example, a piece of land in Klang which was valued at less than RM10 per sq ft can be turned into more than RM100 / sq ft by SP Setia within less than 10 years. Land adjacent to Setia Alam or Setia Eco Park do not carry the same valuation as the one owned by SP Setia. So if you want to buy properties, buy a property company which has a strong perceived brand value. If you disagree, do buy Talam (or Trinity) as they are trading at below NTA. If you noticed, even after Talam has changed name the perceived intangibles of the company is still low.

Negative intangibles is when consumer has negative perception of the company or the brand

Think of Proton. Proton has lost so much value that before it was delisted it was trading at below it NA. Why? Was it undervalued? You may think so now, but why not buy the shares during then? So a brand can have negative value - which is also why whenever there were rumours of Volkswagen or GM taking over the operations of Proton, its share price jumped.

Intangibles is the value we put onto the management and owner

Sometimes management can make a change to the value of the company instantaneously. Remember Steve Jobs and Apple? Most of the times however, it may not create much impact.

In Malaysia, I feel that recently there is a tendency to provide higher valuation to professionally managed companies (especially well managed ones) rather than owner managed companies. I may not know the exact reasons for it but it may go to trust as there are fear of owners who are management themselves influencing the share price or perhaps taken some questionable actions as I have highlighted in Digistar.

Can you see the significance of that value creation as it takes a whole effort to build it? Hence investment is not just Price / NA or PE as there are much more in intangibles to the whole lot effort to valuation.

Friday, July 20, 2012

For a stock picker so difficult to find value now

Seriously, over the past few months, it has been getting tougher and tougher to find value now. Many good stocks are now at more than 20x PE and sometimes, I am just wondering how fast the growth some of those companies can garner. Most of them only have Malaysia as their market hence they tend to pay higher dividends but little capital investment is made anymore.

I just looked at companies like Carlsberg (at one point of time, because of their non-Syariah stock status), they were not that attractive anymore. Over the last 1 - 2 years, it started to move. So is Guinness Anchor. Ya I know that F&N Singapore suddenly became a hot stock as major breweries are eyeing Asian market. Beer stocks became a sudden war for these companies now. I think they will bypass Malaysia though.

Even the one which I have mentioned, Nestle - it has now gone to 30x PE. Banks in Malaysia are now trading at almost 20x PE and more than 2x NA. Provision for bad debts as well as NPLs are very low. Good if we may think, but as in a country with very low unemployment for how long can this last. Already the personal consumption loan is at its high. Indonesia story again? I am hearing of too much Indonesian story - really.

Properties as you know I have mentioned of my apprehensiveness.

I am quite sure for long term investors, it may not be too difficult as the viewpoint is for a longer period and we do have some good companies although more and more of them bypass Malaysia for their listings.

But finding value is really difficult here.

This is especially so when we look at US markets - not for the ones who do not have patience though. I can give examples of companies like some of the banks are now trading at below 0.5x NA, less than 10x prospective earnings. They are still decent banks despite all the hoo-hah on their actions more recently. Even some very good companies are now trading at around 10x PE.

Any good solid pick for Malaysia still?

I just looked at companies like Carlsberg (at one point of time, because of their non-Syariah stock status), they were not that attractive anymore. Over the last 1 - 2 years, it started to move. So is Guinness Anchor. Ya I know that F&N Singapore suddenly became a hot stock as major breweries are eyeing Asian market. Beer stocks became a sudden war for these companies now. I think they will bypass Malaysia though.

Even the one which I have mentioned, Nestle - it has now gone to 30x PE. Banks in Malaysia are now trading at almost 20x PE and more than 2x NA. Provision for bad debts as well as NPLs are very low. Good if we may think, but as in a country with very low unemployment for how long can this last. Already the personal consumption loan is at its high. Indonesia story again? I am hearing of too much Indonesian story - really.

Properties as you know I have mentioned of my apprehensiveness.

I am quite sure for long term investors, it may not be too difficult as the viewpoint is for a longer period and we do have some good companies although more and more of them bypass Malaysia for their listings.

But finding value is really difficult here.

This is especially so when we look at US markets - not for the ones who do not have patience though. I can give examples of companies like some of the banks are now trading at below 0.5x NA, less than 10x prospective earnings. They are still decent banks despite all the hoo-hah on their actions more recently. Even some very good companies are now trading at around 10x PE.

Any good solid pick for Malaysia still?

Thursday, July 19, 2012

Digistar: Anything fishy about buying company with NA of RM89,271 for RM32.5million valuation?

This is not Digi, but on Digistar. I am going to highlight the sequence of event and perhaps you can piece them out as well.

12 October 2010 - Seni Pujaan entered into a Joint Venture with Yayasan DMDI to undertake a property development.

28 April 2011 - Digistar Holdings Bhd subscribed for 150,000 shares of Seni Pujaan for RM150,000 cash. (See below)

28 March 2012 - Seni Pujaan managed to get a loan for RM28 million for development project on the piece of land from UOB Bank. Notice the word third party charge as the land is not owned by Seni Pujaan or Digistar but in fact owned by Yayasan DMDI. (See below)

16 & 19 Jul 2012 - In an announcement and its answer to Securities Commission, Digistar is paying RM13 million for remaining 40% of Seni Pujaan (Net Asset Value RM89,271), the same company it paid RM150,000 for 60% ownership a year ago.

Minority shareholders, you should have asked how come a company which has Net Asset Value of RM89,271 is being bought for RM13 million, 40% stake - hence valuing the company at RM32.5 million. Add on to that, the 60% was for RM150,000 and that was just a year ago.

This deal does not need shareholder's or SC's approval as it is an all cash deal. (See below)

Enough said. Minority Shareholder Watchdog Group - can you help to check on this? I am thinking how can a company with Net Asset Value of RM89,271 and no track record be valued at RM32.5 million...

Don't you think the minorities deserve a better answer?

As I am highlighting this, need to be careful as well.

|

| Note the date where the JV was entered into - 12 October 2010 |

28 April 2011 - Digistar Holdings Bhd subscribed for 150,000 shares of Seni Pujaan for RM150,000 cash. (See below)

28 March 2012 - Seni Pujaan managed to get a loan for RM28 million for development project on the piece of land from UOB Bank. Notice the word third party charge as the land is not owned by Seni Pujaan or Digistar but in fact owned by Yayasan DMDI. (See below)

Minority shareholders, you should have asked how come a company which has Net Asset Value of RM89,271 is being bought for RM13 million, 40% stake - hence valuing the company at RM32.5 million. Add on to that, the 60% was for RM150,000 and that was just a year ago.

This deal does not need shareholder's or SC's approval as it is an all cash deal. (See below)

Enough said. Minority Shareholder Watchdog Group - can you help to check on this? I am thinking how can a company with Net Asset Value of RM89,271 and no track record be valued at RM32.5 million...

Don't you think the minorities deserve a better answer?

As I am highlighting this, need to be careful as well.

Wednesday, July 18, 2012

Property prices beyond reach? Think again.

During good times, banks can act as the lubricant of the economic growth of a country. If over exposed and uncontrolled, banks can also cause havoc to a country's economic health. We do not have to look too far behind - remember the sub-prime crisis in US in year 2008. Started off before Obama's presidency and now it is towards the end of his first term, until today, the housing crisis is yet unresolved.

I could not help thinking why over the last few years - in fact a year after the sub-prime crisis, why is it that the property prices in Malaysia (similarly in many other cities around Asia) jumped by leaps and bounds over a period of just 3 years. For example, I was looking at a piece of leasehold residential land in Kota Damansara - 3 years ago the price it was fetching - RM60 per sq ft, now RM150 per sq ft or even more. Now that's land, I have even heard of completed properties (especially high end) have gone up even more in terms of percentage.

Who is at fault? If you believe me, banks and developers are the biggest speculators. Are they overplaying their role here?

Let me provide you a scenario.

To get a smallish decent little new apartment of around 1,000 sq ft at the outskirt of the KL or PJ city, it would have costs at least RM350,000. You may think that it is very expensive, but try to do some calculations. For a household / person who earns say RM4,000 (now RM4,000 per household in Klang Valley, Penang of JB for that matter is not high), would the person be able to pay for a RM350,000 apartment? Let's look at the calculator provided by Maybank below.

(Let's not talk about renovation as some of the times, the property is for speculation.)

With the repayment that he / she has to make to the bank, what about his lifestyle - can he / she makes ends meet? With RM4,000 income, the take home will probably be around RM3,500. Deduct the loan repayment of RM1,504 - around RM2,000 will be available to pay for transport (if car, bank financing again), utilities, travel costs, food, some slight entertainment. That's tight but for anyone which has some flexibilities from credit card, some little additional claims, bonuses here and there etc., it is possible.

Now, let's look at what has made this possible? Wasn't this same thing made available by the banks 5 - 10 years ago?

Because of the Banks - Interest rates at its lowest

If you look at the BLR table below, because of the spillover effect of sub-prime, Bank Negara has caused reduction of BLR to a historical minimum 5.55%. To top off with that, because of costs of funds for banks have gone much lower, property financing rates have gone below BLR rather than above BLR which was the norm prior to this. Hence, at BLR - 2.4% or even more today for example, borrowers are able to get rates as low as 4% - 4.2%.

The lower the rate, the higher the affordability.

What about years of financing? I remember, prior to 1997, it was 20 - 25 years for maximum years of financing. After the Asian crisis, now there are banks (in fact most) which are providing property financing terms of up to 40 years.

What about developers?

Heard of the 5/95 plan? To make properties even more affordable, I have seen this plan initiated since 2008. Basically the 5/95 plan is to allow buyers to just pay for 5% downpayment for their booking and purchase. The remaining 95% will only be paid upon completion of properties. No interest will be paid during the construction.

Of course banks will still have to approve the loan as the risks of payment is still at the purchasers side. Hence, over here again the banks and developers are working together - knowingly or unknowingly in increasing the value of launches.

(This is different from the Build Then Sell concept which is highly recommended)

In essence, this has caused higher affordability level and of course even more speculations. Why? The person only needs to pay 5%, and nothing else until completion. After completion, some would expect to flip the properties hence making a quick profit out of this speculation albeit from a low upfront downpayment.

This scheme while it is helpful to the developers to sell properties, unfortunately may have caused some over excessive speculations.

Do you now believe the excessive pricing are due more to these 2 sectors rather than inflationary pressure - say oil, or material prices? Do you think that because price of property is part of the CPI, it is inflationary as well?

Now you know why in my blog, I have never covered any property companies or banks, especially now. This is because if there are any economic calamities (and I am not saying for sure there are), do run cover from these sectors fast. More often than not, we would not be able to sell fast enough. The risk for me is a little bit too high.

I couldn't help thinking the design of the packages for the last few years was to allow potential buyers within reach based on the income level, but basically the developers could not care less of what happens when the economy face a slight twitch or banks just could not hold on to the largely consumption loan anymore. Even if there are no crashes in the property prices, I still feel that the overpricing of the properties are due to the two parties - banks and property developers. And some parties have just the role to regulate more to help the man on the streets, as we do not want another Greenspan - who overslept and caught it way too late.

Note: If 16 or less banks can illegally coordinate to control the LIBOR rate, I have no doubt that banks and larger property companies can do the same together and it may not even be illegal in this case.

I could not help thinking why over the last few years - in fact a year after the sub-prime crisis, why is it that the property prices in Malaysia (similarly in many other cities around Asia) jumped by leaps and bounds over a period of just 3 years. For example, I was looking at a piece of leasehold residential land in Kota Damansara - 3 years ago the price it was fetching - RM60 per sq ft, now RM150 per sq ft or even more. Now that's land, I have even heard of completed properties (especially high end) have gone up even more in terms of percentage.

Who is at fault? If you believe me, banks and developers are the biggest speculators. Are they overplaying their role here?

Let me provide you a scenario.

To get a smallish decent little new apartment of around 1,000 sq ft at the outskirt of the KL or PJ city, it would have costs at least RM350,000. You may think that it is very expensive, but try to do some calculations. For a household / person who earns say RM4,000 (now RM4,000 per household in Klang Valley, Penang of JB for that matter is not high), would the person be able to pay for a RM350,000 apartment? Let's look at the calculator provided by Maybank below.

(Let's not talk about renovation as some of the times, the property is for speculation.)

With the repayment that he / she has to make to the bank, what about his lifestyle - can he / she makes ends meet? With RM4,000 income, the take home will probably be around RM3,500. Deduct the loan repayment of RM1,504 - around RM2,000 will be available to pay for transport (if car, bank financing again), utilities, travel costs, food, some slight entertainment. That's tight but for anyone which has some flexibilities from credit card, some little additional claims, bonuses here and there etc., it is possible.

Now, let's look at what has made this possible? Wasn't this same thing made available by the banks 5 - 10 years ago?

Because of the Banks - Interest rates at its lowest

If you look at the BLR table below, because of the spillover effect of sub-prime, Bank Negara has caused reduction of BLR to a historical minimum 5.55%. To top off with that, because of costs of funds for banks have gone much lower, property financing rates have gone below BLR rather than above BLR which was the norm prior to this. Hence, at BLR - 2.4% or even more today for example, borrowers are able to get rates as low as 4% - 4.2%.

The lower the rate, the higher the affordability.

What about years of financing? I remember, prior to 1997, it was 20 - 25 years for maximum years of financing. After the Asian crisis, now there are banks (in fact most) which are providing property financing terms of up to 40 years.

What about developers?

Heard of the 5/95 plan? To make properties even more affordable, I have seen this plan initiated since 2008. Basically the 5/95 plan is to allow buyers to just pay for 5% downpayment for their booking and purchase. The remaining 95% will only be paid upon completion of properties. No interest will be paid during the construction.

Of course banks will still have to approve the loan as the risks of payment is still at the purchasers side. Hence, over here again the banks and developers are working together - knowingly or unknowingly in increasing the value of launches.

(This is different from the Build Then Sell concept which is highly recommended)

In essence, this has caused higher affordability level and of course even more speculations. Why? The person only needs to pay 5%, and nothing else until completion. After completion, some would expect to flip the properties hence making a quick profit out of this speculation albeit from a low upfront downpayment.

This scheme while it is helpful to the developers to sell properties, unfortunately may have caused some over excessive speculations.

Do you now believe the excessive pricing are due more to these 2 sectors rather than inflationary pressure - say oil, or material prices? Do you think that because price of property is part of the CPI, it is inflationary as well?

Now you know why in my blog, I have never covered any property companies or banks, especially now. This is because if there are any economic calamities (and I am not saying for sure there are), do run cover from these sectors fast. More often than not, we would not be able to sell fast enough. The risk for me is a little bit too high.

I couldn't help thinking the design of the packages for the last few years was to allow potential buyers within reach based on the income level, but basically the developers could not care less of what happens when the economy face a slight twitch or banks just could not hold on to the largely consumption loan anymore. Even if there are no crashes in the property prices, I still feel that the overpricing of the properties are due to the two parties - banks and property developers. And some parties have just the role to regulate more to help the man on the streets, as we do not want another Greenspan - who overslept and caught it way too late.

Note: If 16 or less banks can illegally coordinate to control the LIBOR rate, I have no doubt that banks and larger property companies can do the same together and it may not even be illegal in this case.

Tuesday, July 17, 2012

EPF's full withdrawal at 60

It seems that the proposal for full EPF's withdrawal extended to 60 is true. Unfortunately, it went without much to be debated. The time for government knows best is over and yet we are being treated like kids. Priority should be on money management which we are to do ourselves rather than thinking of managing it for us.

C'mon, this is just too disappointing.

My other article on this:

EPF, I want all my money back by 55.

C'mon, this is just too disappointing.

My other article on this:

EPF, I want all my money back by 55.

I may be wrong on FGV's trade?

It seems that I may be wrong on FGV's trade as EPF has been trading down FGV to the extent that it no longer holds 5% (the substantial shareholders) threshold on FGV.

This probably prompted FGV's price to deteriorate to RM5.30. I will continue to question the valuation of FGV as I feel that the more than RM19 billion valuation it has been accorded with is a little too rich. Anyway, EPF, KWAP and Tabung Haji - the 3 funds that have been trading FGV almost daily are so big that any major movement by them would probably rattle the share price of any listed company in Malaysia. We cannot be sure what they are going to do next, aren't we?

This probably prompted FGV's price to deteriorate to RM5.30. I will continue to question the valuation of FGV as I feel that the more than RM19 billion valuation it has been accorded with is a little too rich. Anyway, EPF, KWAP and Tabung Haji - the 3 funds that have been trading FGV almost daily are so big that any major movement by them would probably rattle the share price of any listed company in Malaysia. We cannot be sure what they are going to do next, aren't we?

Meanwhile, read the below very well written article via Reuters on the competing arm of the Indonesian palm oil industry which will provide the much bitter competition against Malaysian palm.

Top palm oil producer Indonesia wants to be more refined

First

Read

Written

by Michael Taylor, Niluksi Koswanage & Chew Yee Kiat

Monday,

16 July 2012 10:22

JAKARTA/KUALA

LUMPUR (July 16): For decades, Indonesia has shipped out tanker loads of raw

palm oil for processing into higher value cooking oil and margarine in

Rotterdam, Mumbai and Kuala Lumpur. Now, the world's No 1 producer of the

edible oil is seeing a more than US$2.5 billion (RM7.95 billion) wave of

investment to build a refining industry that will double its capacity and mean

it could supply the entire needs of Asia's top food consumers - India and

China.

The

transformation - driven by Indonesia's move to slash export duties for

processed oil last October - will heat up competition with rivals such as

Malaysia and send ripples through the palm oil market as new supply pressures

prices of traded refined products such as palm olein, used as cooking oil.

A

Reuters survey of 30 firms operating in Indonesia - from the world's biggest

listed palm oil firm Wilmar to conglomerate Unilever - shows plans to nearly

double refining capacity to 43 million tonnes of palm oil, or 80 percent of

total world output. "The government is sending a clear message - to survive,

you need a refinery. So the palm oil firms are putting their money out and

following the big guys in the industry who have already done so," said

Thomas Mielke, an analyst at industry publication Oil World.

"There

is the threat of over capacity. But palm oil firms with the whole supply chain

behind them, we are talking about having plantations to mills and ports, will

be the kings." Gleaming silver storage tanks standing ten-storeys' high

are becoming a feature of Indonesia's landscape as more refineries spring

up, threatening the stranglehold on processing held by neighbouring Malaysia,

the No.2 palm oil producer. At a newly built refinery near Jakarta, staff

wearing face masks and hair caps work on conveyor belts carrying boxes of margarine

and cooking oil.

The

US$249-million Marunda plant run by PT SMART was launched before the tax change

and Indonesia's top palm oil firm plans to spend a further US$200 million on

new refining capacity despite the infrastructure issues it faced building

Marunda. PT SMART will be one of the biggest investors in the sector along with

Wilmar and unlisted Musim Mas, which plans to spend US$860 million, according

to the survey.

Government

officials in Malaysia and Indonesia say these firms had aggressively lobbied

Jakarta to cut duties on refined palm oil to half those levied on crude. Much

of the expansion is led by companies owned by powerful tycoons in Indonesia.

SMART is controlled by the family of Eka Tjipta Widjaja, who created a palm oil

empire from his humble start selling biscuits from a rickshaw. Foreign firms

are not far behind. Commodities trader Louis Dreyfus formed joint ventures with

planters such as Singapore listed Kencana Agri to build refineries in

Indonesia.

Until

now, Indonesia had focused on expanding plantations. Oil palms cover roughly

8.2 million hectares (20.3 million acres), an area about the size of the island

of Ireland, and their cultivation is often blamed for rainforest destruction.

BRING

DOWN PRICES

Palm

oil, the world's most traded and consumed edible oil, is used mainly as an

ingredient in food such as biscuits and ice cream, or as a biofuel. For

decades, refined palm olein enjoyed premiums of 5-10 percent over crude palm oil

futures. But with more Indonesian supplies coming on stream, more inefficient

refining operations could get shut.

On the flip side,

greater competition could cut final product costs to the benefit of consumers

in India and China, where food inflation is a constant concern for policy

makers. So far this year, palm olein prices have fallen nearly 10 percent on

higher Indonesian supplies. Under its refining plans, Indonesia could meet

domestic needs of around 10 million tonnes annually as well as supplying the combined

20 million tonnes of edible oil imports required by top buyers China and India.

Indonesia's crude

palm oil output - estimated at 23 to 25 million tonnes in 2012 - looks set to

be outpaced by the planned increase in refining capacity in the next two years.

That means some palm oil firms may build refineries run at lower capacities

until more edible oil supply comes in. DBS analyst Ben Santoso said latecomers

to Indonesia's refining business could see margins squeezed to US$40 per tonne from

US$70, although still healthier than its main competitor.

"The

capacity of some of these smaller companies will turn idle. But let's not

forget, Malaysia's refining margin is just US$9 to US$10 a tonne," he

added.

MALAYSIA AND

INDIA FEEL THE PRESSURE

As Indonesia

rushes to build refineries, vegetable oil refiners in Malaysia and India are

feeling the pressure. "I am having sleepless nights. I have closed down

30-40 percent of my factory and I hope it won't be more," said a refiner

in Malaysia's Johor state.

Malaysia

currently has 22.9 million tonnes of refining capacity, with only about three

quarters of it used last year down from a record 90 percent in 2005. And this

shows in exports. Malaysia's combined refined palm olein exports in April and

May dropped 19 percent to about one million tonnes from a year ago, according

to cargo surveyors.

Indonesian palm

olein shipments jumped 55 percent in the same period to nearly 600,000 tonnes. Malaysia could

respond by removing a tax free export quota for crude palm used to feed the

overseas factories of some firms or replicate Indonesia's tax system to level

the playing field. Both options are politically risky with an election on the

horizon, as they entail taxing crude palm oil that in Malaysia is mostly produced

by small farmers who make up the bulk of the electorate and come under the tax

free export quota.

To capitalise on

Indonesia's export tax changes, Malaysia's top planter Sime Darby is building

an Indonesian refinery. KL Kepong and IOI Corp are expected to follow suit. India,

the world's largest edible oil buyer, has been fending off industry calls to

hike the import duty on refined palm oil to stem the inflow

of cheap cargoes from Indonesia for fear of stoking inflation. India currently

imposes a 7.5 percent tax on refined palm oil from Indonesia. But it is still

US$15 cheaper a tonne to import Indonesia's

processed palm oil than to ship in crude and refine it, traders say.

"Before

Indonesia changed the export taxes, a lot of refiners were expanding their

factories," said Ashok Sethia, President of the Solvent Extractors

Association of India. "Now all those plans have been abandoned," he

added. Refined palm olein used to make up below 5 percent of total imports and

now accounts for nearly 20 percent of 883,410 tonnes shipped into India in May.

This will make it hard for India to preserve its processing capacity of 15

million tonnes.

SENSITIVE POLICY

Palm oil is just

part of Indonesia's efforts to attract investment and squeeze more from its

agricultural and mineral resources, a policy that has sometimes backfired. In

May, Indonesia imposed a 20 percent tax on some metal ore exports and told

miners to submit plans to build smelters or process ore domestically. The government

says this should help Indonesia earn more revenue, although a union said miners

had laid off more than 200,000 workers since the ruling.

Taxes on palm oil

were introduced in 1994 with the aim of ensuring palm-based cooking oil was

available in the developing country of more than 200 million people. But the

system fell apart when the rupiah currency collapsed during the Asian financial

crisis in the late 1990s, prompting palm oil firms to

export more and triggering food riots at home. With this in mind, export taxes

on crude palm oil were kept much lower than on refined oil to shore up domestic

supply. That frustrated the processing industry with many firms thinking of

exiting Indonesia in 2010 and 2011, said Sahat Sinaga, executive director of

the Indonesian Vegetable Oil Refiners Association.

"If the

government did not take action, we would have just remained a crude palm oil

exporter and earned much less," said Sinaga." - Reuters

Monday, July 16, 2012

Maxis Malaysia and the power of cashflow

I have written about the power of cashflow for company like AEON where they basically used suppliers financing to finance some part of their business. Of course business like AEON will need to do the investment first (such as capital expenditure on buildings, land, equipment etc) then only they will stuff suppliers goods in their outlet. Collections are in cash, payment to suppliers can be up to 90 days.

This time, I am going to introduce another company which on its balance sheet, it can seemingly be seen as insolvent as it is on negative tangible asset value but yet the company is valued at RM48 billion valuation.

Just look at above - as at 31 Dec 2011, Maxis has locked in a intangible assets of RM11.06 billion while cash holding was just RM838 million. Total equity at that period was RM8.088 billion hence the company's total NTA was negative RM2.971 billion. To add further, its total borrowings was RM5.873 billion as shown below. Is its balance sheet under duress? Hell NO.

Why?

Just look at the amount of cashflow it is generating yearly. Operating cashflow of over RM4.3 billion yearly. From these cashflow, how much are needed to invest into the maintenance or ungrading of equipment. Lets look at another table...

Based on below, it is reinvesting somewhere between RM1 - 1.5 billion for equipment upgrades or enhancement.

Hence, the net free cashflow Maxis Malaysia is generating is in excess of RM3 billion yearly. This is why they can be more than RM5.8billion in debt, negative NTA and yet the market is valuing Maxis at RM48 billion. Of course, the company is generating Net Profit of more than RM3billion as well, yearly.

You may want to ask, if the company is generating so much cashflow, how come its balance sheet is in so bad shape?

Remember, the delisting and listing back in Bursa. Well the delisting is for some magic financial trick where all the major absorb-dable debts are park at Maxis Malaysia, the vehicle to issue dividend as well and at the same time it can still get good decent valuation. The one that needs much more funds and perhaps may not be generating such cashflow will be held private and not seen in the eyes of public. (When you do not have a beautiful wife why bring them out that often?)

After the financial cleansing are done, they then list Maxis Malaysia. Usually Ananda's stable would be showing (and listing) the nice companies with strong cashflow so that they can issue (and proven to) dividends, while the non-paying dividends companies will usually be held private. This is because Malaysian investors are quite a sucker for dividends (me inclusive), hence the valuation.

A better example of a Malaysian telco with full-fledged regional operations where one country's operations will provide the cashflow while some other countries will absorb / use up the cash generated - look at Axiata. You will get a bigger and better picture from there as not all telcos are purely cash generating alone.

This time, I am going to introduce another company which on its balance sheet, it can seemingly be seen as insolvent as it is on negative tangible asset value but yet the company is valued at RM48 billion valuation.

Just look at above - as at 31 Dec 2011, Maxis has locked in a intangible assets of RM11.06 billion while cash holding was just RM838 million. Total equity at that period was RM8.088 billion hence the company's total NTA was negative RM2.971 billion. To add further, its total borrowings was RM5.873 billion as shown below. Is its balance sheet under duress? Hell NO.

|

| Borrowings for Maxis Malaysia |

Why?

Just look at the amount of cashflow it is generating yearly. Operating cashflow of over RM4.3 billion yearly. From these cashflow, how much are needed to invest into the maintenance or ungrading of equipment. Lets look at another table...

|

| Operating Cashflow of Maxis Malaysia |

Hence, the net free cashflow Maxis Malaysia is generating is in excess of RM3 billion yearly. This is why they can be more than RM5.8billion in debt, negative NTA and yet the market is valuing Maxis at RM48 billion. Of course, the company is generating Net Profit of more than RM3billion as well, yearly.

You may want to ask, if the company is generating so much cashflow, how come its balance sheet is in so bad shape?

Remember, the delisting and listing back in Bursa. Well the delisting is for some magic financial trick where all the major absorb-dable debts are park at Maxis Malaysia, the vehicle to issue dividend as well and at the same time it can still get good decent valuation. The one that needs much more funds and perhaps may not be generating such cashflow will be held private and not seen in the eyes of public. (When you do not have a beautiful wife why bring them out that often?)

After the financial cleansing are done, they then list Maxis Malaysia. Usually Ananda's stable would be showing (and listing) the nice companies with strong cashflow so that they can issue (and proven to) dividends, while the non-paying dividends companies will usually be held private. This is because Malaysian investors are quite a sucker for dividends (me inclusive), hence the valuation.

A better example of a Malaysian telco with full-fledged regional operations where one country's operations will provide the cashflow while some other countries will absorb / use up the cash generated - look at Axiata. You will get a bigger and better picture from there as not all telcos are purely cash generating alone.

Sunday, July 15, 2012

Maxis-Redtone 4G deal: Is this how the telco players are moving forward?

MAXIS Bhd has signed an infrastructure sharing agreement with REDtone

International Bhd, for both parties to offer better high speed

wireless broadband services.

This will be done by combining their soon-to-be-awarded 4G spectrum.

Earlier, there are news that the Malaysian government is providing 9 licenses to telcos - in my opinion my order of companies strength - Maxis, Celcom, Digi, YTL Communications, UMobile, Green Packet, Redtone, Syed Mokhtar's linked telco, Asiaspace.

--------------------------------------------------------------------------------------------------

There is no doubt that this deal will be beneficial for both parties as it is mentioned it allows the companies to save costs while at the same time fast tracking their rollout. No other terms are revealed, for example the pricing terms for usage of each others network etc. Hence, we do not know.

My question is that since there are 3 mobile players which are head and shoulders above the rest, would this method be used by Celcom and Digi as well. They would definitely be needing much bigger network than the smaller players. The smaller players on the other hand needs money to even kick start their rollout.

I am sure MCMC's intention in awarding the 4G LTE's license is for the players to end up being operator rather than selling network. They can be operator allright but to make it big from being operator, I am not able to see it beyond Maxis, Celcom and Digi still.

This deal is still beneficial to Redtone though, although at the moment its share price is already quite full. The RM150 million value that the market provides to Redtone is largely on the license which it holds - absolutely bizarre. For a company like Redtone, to be a full fledged operator, I see them raising funds just like what Green Packet and UMobile did. Remember to be an operator, network is just one part of the solution. Devices, billing systems, distribution, customer service, marketing, advertising etc. - you will still need those especially in a retail network.

Let's see where it leads to.

This will be done by combining their soon-to-be-awarded 4G spectrum.

Earlier, there are news that the Malaysian government is providing 9 licenses to telcos - in my opinion my order of companies strength - Maxis, Celcom, Digi, YTL Communications, UMobile, Green Packet, Redtone, Syed Mokhtar's linked telco, Asiaspace.

--------------------------------------------------------------------------------------------------

There is no doubt that this deal will be beneficial for both parties as it is mentioned it allows the companies to save costs while at the same time fast tracking their rollout. No other terms are revealed, for example the pricing terms for usage of each others network etc. Hence, we do not know.

My question is that since there are 3 mobile players which are head and shoulders above the rest, would this method be used by Celcom and Digi as well. They would definitely be needing much bigger network than the smaller players. The smaller players on the other hand needs money to even kick start their rollout.

I am sure MCMC's intention in awarding the 4G LTE's license is for the players to end up being operator rather than selling network. They can be operator allright but to make it big from being operator, I am not able to see it beyond Maxis, Celcom and Digi still.

This deal is still beneficial to Redtone though, although at the moment its share price is already quite full. The RM150 million value that the market provides to Redtone is largely on the license which it holds - absolutely bizarre. For a company like Redtone, to be a full fledged operator, I see them raising funds just like what Green Packet and UMobile did. Remember to be an operator, network is just one part of the solution. Devices, billing systems, distribution, customer service, marketing, advertising etc. - you will still need those especially in a retail network.

Let's see where it leads to.

Saturday, July 14, 2012

How is Padini faring?

Padini is one company that has done extremely well over the last 5 years. Its share price has also done very well climbing more than 100% over the last 1 year. Is it justified? It is now worth more than RM1.3 billion, not bad for an apparel and shoes company which relies on 90% of its revenue from Malaysia. Can this sustain?

Firstly, let's look at what does it do so that we would like to know what kind of metrics we would concentrate on. Padini is an apparel company with brands such as Padini (men and women), Vincci (women's shoes), Seed, Miki (children's apparel), P&Co and several other smaller brands. In terms of operations, it operates its own outlet namely Padini Concept Store and Brands Outlet. Besides that, it sells its merchandise through supermarket outlet as well throughout Malaysia. It has smaller operations overseas which only contributes 10% of revenue to the group.

If you ask me, in terms of the branding of apparels and shoes, Padini's positioning is towards lower to mid level brand targeting younger generations. In terms of competition, obviously it is a very competitive space, but to me as long as company has proven to do well, competition is not a major factor.

Anyway for an apparel company like Padini what do we want to look at?

Looking at above, hence what do you see?

This company it seems has been able to stand on its own despite the tough competition in the space it is competing in. Who says Malaysian company is not able to compete despite we see overseas brand coming into the local market?

Despite some concerns over macroeconomy of the country due to spill over effect from Europe and even the slowing down of China, I would think Padini is a company which will be able to compete on its own ground. I am impressed actually.

What about the pricing? I am expecting the company to be trading at around 12x to 13x PE based on its current price of RM1.95. Not too bad still (despite the growth in price in the last 12 months). But not that cheap either.