Sharing is CARING? Not in the dictionary.

This is what happened when an owner is already too rich and has too much food on the table.

Basically, the rights nobody dare to take and it is trading at RM0.005 - i.e. a price that cannot go lower anymore.

JKG Land, has a project in Segambut (formerly Goh Ban Huat's land). The project is called The Era, and it has a GDV of RM2.1 billion.

If nobody takes up the rights, the owner will just take all as in the circular, as the main controlling shareholder has underwritten all the rights issuance. It comes to RM151.7 million. Hence, my guess is that the owner will not even buy the OR as he can get the shares at 10 sen - why bother to even buy the 0.5 sen OR?

Talking about sharing wealth, philanthropy and one man takes all. They just do not jive.

My question is, what's the point of listing?

Monday, March 27, 2017

Saturday, March 25, 2017

Not all things on Alibaba (or Jack Ma) is great

When Jack Ma said that he is not taking salary being an advisor on Malaysian digital economy aspiration - he does not need to. How much that position pays anyway? There is a word of caution on getting too close and give up too much to these people.

When a person is rich, he is always a hero. That's a reality. Heroes are made from the winners, not losers.

In turning Malaysia as a digital free trade zone hub is great, but too much given to Jack Ma is potentially not good.

I would like to point to the event from these articles where one can read from here, here, here. You can also find out the event, by googling "Jack Ma Yahoo Alipay".

That event literally, puts into contention that Jack Ma transferred the entire Alipay into his own holding - and both its largest shareholders being Yahoo and Softbank claimed that they did not know about it. In the western world, there would be lawsuits, but in China it is different. Note that Alipay is worth in excess of USD50 billion today. That's a big loss to Yahoo.

Shall I say, in that event, there is this "40 thieves" element in Alibaba. If he did not do wrong, why would he gave up some portion of return to Yahoo in the event of IPO - only later when Yahoo complained?

One should note that there is NO WAY these kind of things can be churned out in most parts of the world except China. When your investors are Yahoo and Softbank, there is no way I can even dare to dream of doing this, but he did it.

Jack Ma is a businessman and a Chinese (from China) man. There is this saying, "The only thing straight about a China man is the hair."

This is the kind of person where our Malaysian government is dealing with. He is a businessman and again a China man. Of course, you welcome him, he will come - he already has business intentions here by virtue of buying stake in Lazada. He has nothing to lose but much to gain.

On a side note, I also noticed that in today's article Thestar, What's cooking in penny stocks, it was mentioned:

Using these big numbers and the China factor, blogs have started talking up the likes of Dataprep Holdings Bhd, GHL Systems Bhd, Rev Asia Bhd, Cuscapi Bhd, Malaysia Airport Holdings Bhd, AirAsia Bhd, DKSH Bhd and Tropicana Bhd, among others.

Airasia, DKSH and Tropicana are linked to my article. I hope that the writer from Star can distinguish a joke and a serious opinion. While Airasia could benefit a little, obviously, DKSH and Tropicana have nothing to do with the DFTZ! The only thing that can be positive from there is that if Malaysian economy is doing well, these companies will do well - but there is no obvious linkage.

Note:

If one is to read the Jack Ma's story, it is a highly inspirational story - from a real underdog and truly a rags to riches.

I am also all for a DFTZ concept as in my other articles.

When a person is rich, he is always a hero. That's a reality. Heroes are made from the winners, not losers.

In turning Malaysia as a digital free trade zone hub is great, but too much given to Jack Ma is potentially not good.

I would like to point to the event from these articles where one can read from here, here, here. You can also find out the event, by googling "Jack Ma Yahoo Alipay".

That event literally, puts into contention that Jack Ma transferred the entire Alipay into his own holding - and both its largest shareholders being Yahoo and Softbank claimed that they did not know about it. In the western world, there would be lawsuits, but in China it is different. Note that Alipay is worth in excess of USD50 billion today. That's a big loss to Yahoo.

Shall I say, in that event, there is this "40 thieves" element in Alibaba. If he did not do wrong, why would he gave up some portion of return to Yahoo in the event of IPO - only later when Yahoo complained?

One should note that there is NO WAY these kind of things can be churned out in most parts of the world except China. When your investors are Yahoo and Softbank, there is no way I can even dare to dream of doing this, but he did it.

Jack Ma is a businessman and a Chinese (from China) man. There is this saying, "The only thing straight about a China man is the hair."

This is the kind of person where our Malaysian government is dealing with. He is a businessman and again a China man. Of course, you welcome him, he will come - he already has business intentions here by virtue of buying stake in Lazada. He has nothing to lose but much to gain.

On a side note, I also noticed that in today's article Thestar, What's cooking in penny stocks, it was mentioned:

Using these big numbers and the China factor, blogs have started talking up the likes of Dataprep Holdings Bhd, GHL Systems Bhd, Rev Asia Bhd, Cuscapi Bhd, Malaysia Airport Holdings Bhd, AirAsia Bhd, DKSH Bhd and Tropicana Bhd, among others.

Airasia, DKSH and Tropicana are linked to my article. I hope that the writer from Star can distinguish a joke and a serious opinion. While Airasia could benefit a little, obviously, DKSH and Tropicana have nothing to do with the DFTZ! The only thing that can be positive from there is that if Malaysian economy is doing well, these companies will do well - but there is no obvious linkage.

Note:

If one is to read the Jack Ma's story, it is a highly inspirational story - from a real underdog and truly a rags to riches.

I am also all for a DFTZ concept as in my other articles.

Friday, March 24, 2017

Buying Gamuda-WE and selling Ecoworld and Insas-WB

I have to admit, I trade much lesser than many. Usually, my style is to buy and lay low during bad market times. When it gets hot like what it is right now, I will try to reposition some of my holdings. I can do this because I see stocks as a long term investment and if you read most of articles, these money that I put in is meant to be held long term.

For those that have need for the shorter term, such as children's education needs, medical, house deposits, car deposits, my style of investment is not really ideal. You can however still invest based on the percentage that you are comfortable with.

All these while, if you have looked at my past records, all of those purchases that are made are really fundamental stocks except for a small handful which fundamental have changed. Among those are YFG and Parkson and maybe even AEON.

Over the last 2 days, besides buying Freight Management, I have also done the following:

For those that have need for the shorter term, such as children's education needs, medical, house deposits, car deposits, my style of investment is not really ideal. You can however still invest based on the percentage that you are comfortable with.

All these while, if you have looked at my past records, all of those purchases that are made are really fundamental stocks except for a small handful which fundamental have changed. Among those are YFG and Parkson and maybe even AEON.

Over the last 2 days, besides buying Freight Management, I have also done the following:

- sold all of my Ecoworld at RM1.50.

I thought that since there are potentially other stocks which may be more attractive, I can opt to let go EcoWorld and revisit this stock later. There is no doubt that EcoWorld is still a very attractive stock. It has the best management, which is why I have bought them, and this company will be one of the best property players (if not the best) in the years to come.

In selling, Ecoworld, I have also opt to take the offer for shareholders to take up EcoWorld International which is going for IPO soon. I was offered only 700 units but I did apply for excess and I will report when if I am provided more.

2. sold all of Insas-WB

I think this is because of the premium of about 41 sen and perhaps it is a little too high for my liking. I will still hold Insas.

3. Purchase 3500 of Gamuda-WE

If Insas-WB has a high premium, Gamuda-WE (exercise price-RM4.05) on the other hand, has a 3.21% premium and it has 4 more years (6 March 2021) to expiry. In purchasing Gamuda-WE, I obviously am confident of the parent company. It is trading at RM5.29 now. To be in the money, Gamuda has to move to RM5.44. I am confident of it able to move beyond RM5.50 or more, in the next few years considering the projects that it has gotten. One of the largest, where Gamuda is the project delivery partner - MRT2, has just commenced.

As compared to many of my other holdings, I do not think I will need to introduce Gamuda much. Most of the analysis done are about to what I believe. It owns toll concession assets - Litrak, Kesas, SPRINT. It is trying to sell its water concession - SPLASH.

As compared to many of my other holdings, I do not think I will need to introduce Gamuda much. Most of the analysis done are about to what I believe. It owns toll concession assets - Litrak, Kesas, SPRINT. It is trying to sell its water concession - SPLASH.

Has many construction projects on hand - MRT2, completing MRT1, Pan Borneo (to the tune of RM8 billion order book) and many are speculating the company is in very good position to at least get future rail projects such as Gemas-JB rail, East Coast Rail Line. Basically, this is one of the best construction firm in Malaysia and currently construction theme is still pretty hot.

The run up of a penny stock

The recent run up of some of the penny stocks is just an opportunity for the owners to get out. The below is one of them. All of them are sales and in very large quantities - more than 10% of the total stocks available (done in a day or two) - can one imagine?

The link here, is just one of the example. For any speculators (who gambles), one should wish that he/she followed the right wave. Otherwise, there would not be any more comebacks as these are stocks which the controlling shareholders do not want at all. In fact, they know they do not want the warrants especially to be converted. They just want to dump it out. Even if it is converted, one do not know how they are going to use the money raised.

If there is a second wave, it is really luck. I would not want to touch these in all scenarios although can be tempting.

Disclaimer: Not all penny stocks are bad, but the above is not one of the good ones.

The link here, is just one of the example. For any speculators (who gambles), one should wish that he/she followed the right wave. Otherwise, there would not be any more comebacks as these are stocks which the controlling shareholders do not want at all. In fact, they know they do not want the warrants especially to be converted. They just want to dump it out. Even if it is converted, one do not know how they are going to use the money raised.

If there is a second wave, it is really luck. I would not want to touch these in all scenarios although can be tempting.

Disclaimer: Not all penny stocks are bad, but the above is not one of the good ones.

Thursday, March 23, 2017

Revisiting Freight Management as an investment

Traditionally, Malaysia has always been a strong hub for trade. With trade, comes the services needed towards trade, i.e. logistics, which involved the services required of it including, haulage, trucking, clearance etc. Now, I believe will involve another wave of logistic enhancements in Malaysia especially with the expansion of e-commerce.

If one can remember in 2012/2013, DRB-Hicom made a huge purchase of Proton. The Proton deal does not do good for the group as it created huge losses over the last few years. However, if one can remember, at almost the same time, it also acquired a controlling stake (then was around 30+%) in POS Malaysia.

Over time, it has managed to hold a more than 50% of POS Malaysia through several exercises - among them acquisition of Konsortium Logistik Berhad, restructuring through injection of KLAS and several other smaller companies.

Why is it doing this? It sees opportunities.

Along this period as well, there have been so many strategic partnerships or business investments involving the logistic companies. I only need to point a few here (besides the DRB's move) and one will be able to see it - Yamato's entry into GDEX, Tasco's acquisition of Gold Cold chain, Korea's CJ acquisition into Century Logistic and several more. Why out of a sudden?

The government over the last few years have been talking about expansion in this area of business. Logistics involve plenty - from ports, highways, airports, business infrastructure, people talent and the business enablement. Imagine, we are continuously talking about building new ports or at the very least expanding the existing ones.

I strongly believe that the continuous investment into this area of business will successfully enhance Malaysia as a strong logistic hub. I believe that in several areas, such as banking, plantations, upstream oil and gas and even construction - we can only do so much in Malaysia. But in logistics, because of our geographical location - we can have more than our country's capacity can provide. It definitely involves services strength and Freight Management is largely about that.

What about Freight Management that interests me

Not a household name, but in any case there are rarely household names in freight businesses.

As a listed company, it is one of the least noticeable. (The lesser the people notices, the better.) It is in a growing space and it has great management which I will explain below. Also, importantly, it is not expensive (RM245 million market cap, PE around 10x-12x) and yet to really move much in terms of stock price as compared to many other companies recently. Dividend is also consistent and yield is good.

Not everything requires the ownership of the entire foodchain - integrated offerings no doubt - but one does not need to own all. Freight Management is about that. I had an article which I would like to bring back. In fact, there has not been much changes of its business since that article. Additionally, one can understand the business more here and here. In terms of business, I like it for its asset light-er strategy as compared to many other competitors.

When a company has a strategy of less asset, it has to have a strong services and integration arm.

The statement by the CEO sums it:

For the last two years, its revenue has stagnated a bit but this has picked up for its FY2017 as highlight below. The main thing is that though, its revenue growth is pretty consistent (as well as Profits) over the last 10 years which signifies the strength of the management. The CEO has mentioned of 15% growth target annually.

During 2015 and 2016, there was a period where business volume has gotten tougher partly due to challenges in reduced consumption due to GST and the challenging international trade scenario, as probably volume in/out China has been affected. This is also, as mentioned in the article, where the company invested into a new warehouse for pharmaceuticals and healthcare. Hence, its depreciation has increased.

Freight's strength is in seafreight business (quite common) while 3PL & warehousing and airfreight comes in a distant second and third.

In terms of the type of services and container mode, its import and export is quite balance - potentially signifies that, Freight mainly does operations for its export clients which will be importing and value add and later exports those products AND/OR, its customer type is just well-balanced.

On e-commerce, it has embarked on that space by having a 65% stake in FM Hubwire Sdn Bhd. This is still preliminary and it is not profitable. It just to show that it is looking at this space as an opportunity.

Dividends

As provided in Diagram 1 above, its dividend numbers have been pretty consistent - upped from 4% in FY2012 to 5% in FY2016. This is despite its profit coming down for 2015 and 2016. Normally, for a company to be able to do that - it has 2 things in mind - the reduced profitability is only short term in nature (hence it has comfort to provide a consistent dividend) and cashflow is strong enough for it to do that. At 5% dividend, that translates to about 3.78% dividend yield. (I know that at this moment, it is not that important when stocks are appreciating, but when the tides run low - you know what the rest of the sentence will say).

I have decided to purchase 7000 units at RM1.32.

Note: Not all freight and logistic companies do well, but Freight Management seems to be the one that does well.

If one can remember in 2012/2013, DRB-Hicom made a huge purchase of Proton. The Proton deal does not do good for the group as it created huge losses over the last few years. However, if one can remember, at almost the same time, it also acquired a controlling stake (then was around 30+%) in POS Malaysia.

Over time, it has managed to hold a more than 50% of POS Malaysia through several exercises - among them acquisition of Konsortium Logistik Berhad, restructuring through injection of KLAS and several other smaller companies.

Why is it doing this? It sees opportunities.

Along this period as well, there have been so many strategic partnerships or business investments involving the logistic companies. I only need to point a few here (besides the DRB's move) and one will be able to see it - Yamato's entry into GDEX, Tasco's acquisition of Gold Cold chain, Korea's CJ acquisition into Century Logistic and several more. Why out of a sudden?

The government over the last few years have been talking about expansion in this area of business. Logistics involve plenty - from ports, highways, airports, business infrastructure, people talent and the business enablement. Imagine, we are continuously talking about building new ports or at the very least expanding the existing ones.

I strongly believe that the continuous investment into this area of business will successfully enhance Malaysia as a strong logistic hub. I believe that in several areas, such as banking, plantations, upstream oil and gas and even construction - we can only do so much in Malaysia. But in logistics, because of our geographical location - we can have more than our country's capacity can provide. It definitely involves services strength and Freight Management is largely about that.

What about Freight Management that interests me

Not a household name, but in any case there are rarely household names in freight businesses.

As a listed company, it is one of the least noticeable. (The lesser the people notices, the better.) It is in a growing space and it has great management which I will explain below. Also, importantly, it is not expensive (RM245 million market cap, PE around 10x-12x) and yet to really move much in terms of stock price as compared to many other companies recently. Dividend is also consistent and yield is good.

Not everything requires the ownership of the entire foodchain - integrated offerings no doubt - but one does not need to own all. Freight Management is about that. I had an article which I would like to bring back. In fact, there has not been much changes of its business since that article. Additionally, one can understand the business more here and here. In terms of business, I like it for its asset light-er strategy as compared to many other competitors.

When a company has a strategy of less asset, it has to have a strong services and integration arm.

The statement by the CEO sums it:

(The company specialises in transporting less than a container load (LCL) for customers which Chew says is a niche business. “We are probably the only listed company that sees freight being our core business. Some other similar companies may be strong in third-party logistics, warehousing or even the last mile delivery,”)

|

| Diagram 1: Last 5 years numbers |

For the last two years, its revenue has stagnated a bit but this has picked up for its FY2017 as highlight below. The main thing is that though, its revenue growth is pretty consistent (as well as Profits) over the last 10 years which signifies the strength of the management. The CEO has mentioned of 15% growth target annually.

During 2015 and 2016, there was a period where business volume has gotten tougher partly due to challenges in reduced consumption due to GST and the challenging international trade scenario, as probably volume in/out China has been affected. This is also, as mentioned in the article, where the company invested into a new warehouse for pharmaceuticals and healthcare. Hence, its depreciation has increased.

Freight's strength is in seafreight business (quite common) while 3PL & warehousing and airfreight comes in a distant second and third.

In terms of the type of services and container mode, its import and export is quite balance - potentially signifies that, Freight mainly does operations for its export clients which will be importing and value add and later exports those products AND/OR, its customer type is just well-balanced.

On e-commerce, it has embarked on that space by having a 65% stake in FM Hubwire Sdn Bhd. This is still preliminary and it is not profitable. It just to show that it is looking at this space as an opportunity.

Dividends

As provided in Diagram 1 above, its dividend numbers have been pretty consistent - upped from 4% in FY2012 to 5% in FY2016. This is despite its profit coming down for 2015 and 2016. Normally, for a company to be able to do that - it has 2 things in mind - the reduced profitability is only short term in nature (hence it has comfort to provide a consistent dividend) and cashflow is strong enough for it to do that. At 5% dividend, that translates to about 3.78% dividend yield. (I know that at this moment, it is not that important when stocks are appreciating, but when the tides run low - you know what the rest of the sentence will say).

I have decided to purchase 7000 units at RM1.32.

Note: Not all freight and logistic companies do well, but Freight Management seems to be the one that does well.

Wednesday, March 22, 2017

My AliBaba story

I have been thinking of my AliBaba story since a lot of people are trying to figure out where to put their money - you see Jack Ma is in town and this is the time to really make a killing. He in fact already has a company which he controls and in case you want to take the opportunity of buying his holdings, can approach Lazada for a private sale.

Anyway, as I have been thinking, I realised I have almost all the plans and investments lined up except for filling in one or two gaps that are still there. You see many years ago, I already knew that e-commerce was going to be big in Malaysia and this region. With e-commerce, there will be distribution, transportation and lastly finance.

WCE

When the government approved the alignment for the new highway for West Coast Expressway (formerly Keuro), I knew that it was going to be a major highway to connect the main ports. Alibaba is about logistics and connectivity. WCE is connecting Port Klang to KLIA. It is also the faster route from Port Klang to Lumut and to Penang Port. WCE's management has already mentioned of WCE potentially being a port to port connecting highway and since it is a much flatter route, it is very friendly towards trucks and heavy vehicles.

Now, I have already road, what about air?

Airasia

Can you see, Airasia? Long, long time ago before Jack Ma stepped foot onto Malaysia or even knew Malaysia existed (I believe that as Jack Ma has always claimed that he was never a clever person anyway, hence his direction and geography is pretty bad), Tony Fernandez already knew of AliBaba. Hence, he created a direct route from KLIA to Hangzhou, where AliBaba's head office is.

MAS never had that route. So, you can see that Tony really had that foresight. Now, today with Jack Ma coming to Malaysia in a big way, it is going to be really positive for Airasia. There will be a lot of people connecting between Hangzhou and KL, not needing to go through Shanghai which is another 1 hour away.

For AliBaba's staffs, speed is important. Airasia is now transporting people as well as goods (cargo). Hence, the connectivity between Hangzhou and KL is really getting important. I am really glad that the company I invested in has that foresight.

DKSH

Even before Airasia and WCE, I have put my money into DKSH. As everyone know, DKSH is a logistic company. It in fact is one of the largest distributor in Malaysia. Malaysia is building itself into a distribution hub. Through that, DKSH will be in a good position.

Maybe, AliBaba will want to acquire DKSH? (Purely, speculative) You see, in acquiring DKSH, the Swiss parent, it will be able to acquire a substantial operation for South East Asia region.

Now, since I have road, air and distribution figured out, I am looking for sea (anyone can help here?)

Tropicana and Ecoworld

Everyone knows now that Alibaba is a Top 10 market company globally. It has hence created a lot of millionaires and billionaires. Its employees are definitely doing very well. When they come to Malaysia, they would want to buy nice big homes which are nearer to KLIA - the distribution hub proposed. Ecoworld's EcoMajestic and Tropicana Aman is just 20 km away and they produced the most beautiful homes and "taman" in South Klang Valley. Surely, the employees from Alibaba will be buying or at least renting these homes.

Insas

You see, the largest holding for Insas is a company called Inari. Inari is building semiconductor chips and Alibaba being a technology based company can make use of Inari chips? I am sure there are some relevancy here as Inari produces for Broadcom and Broadcom is very big in data center chip solutions. Alibaba going big into Aliyun (data center cloud services - much like Amazon Web Services) will definitely be beneficial for Inari, hence Insas.

What about me? The poor TA

As you can see, Alibaba is also going big into consumer credit (micro) businesses - through AliPay. Jack Ma knows that he cannot buy a bank as it is not possible regulations wise. He hence looks out for companies that provide transaction services. In Malaysia, some of these companies holds credit lending license - and TA is one of them. TA is in fact ideal as it has the strong credit standing, reach and perhaps the owners are now more keen on doing properties than credit and stockbroking. Hence, Jack! if you want to buy a credit licence, perhaps can consult me? Hey...

Ekovest leh?

Simple. Ekovest is linked to IWCITY. IWCITY is linked to Bandar Malaysia. And Bandar Malaysia is linked to HSR rail and KLIA as well. See...

I hope my story is much more bombastic yet believable than many out there including here, here, and another one from DNEX.

Note: Most of the stories are fake and please do not bring to SC and say that I have been convincing you to buy these stocks. You see, I do not do "pump and dump", because generally I am too dumb not to dump.

However, it is true to my believe that transportation, logistics are key to the growth of e-commerce in the region which is the main gist of my holdings.

Anyway, as I have been thinking, I realised I have almost all the plans and investments lined up except for filling in one or two gaps that are still there. You see many years ago, I already knew that e-commerce was going to be big in Malaysia and this region. With e-commerce, there will be distribution, transportation and lastly finance.

WCE

When the government approved the alignment for the new highway for West Coast Expressway (formerly Keuro), I knew that it was going to be a major highway to connect the main ports. Alibaba is about logistics and connectivity. WCE is connecting Port Klang to KLIA. It is also the faster route from Port Klang to Lumut and to Penang Port. WCE's management has already mentioned of WCE potentially being a port to port connecting highway and since it is a much flatter route, it is very friendly towards trucks and heavy vehicles.

Now, I have already road, what about air?

Airasia

Can you see, Airasia? Long, long time ago before Jack Ma stepped foot onto Malaysia or even knew Malaysia existed (I believe that as Jack Ma has always claimed that he was never a clever person anyway, hence his direction and geography is pretty bad), Tony Fernandez already knew of AliBaba. Hence, he created a direct route from KLIA to Hangzhou, where AliBaba's head office is.

MAS never had that route. So, you can see that Tony really had that foresight. Now, today with Jack Ma coming to Malaysia in a big way, it is going to be really positive for Airasia. There will be a lot of people connecting between Hangzhou and KL, not needing to go through Shanghai which is another 1 hour away.

For AliBaba's staffs, speed is important. Airasia is now transporting people as well as goods (cargo). Hence, the connectivity between Hangzhou and KL is really getting important. I am really glad that the company I invested in has that foresight.

DKSH

Even before Airasia and WCE, I have put my money into DKSH. As everyone know, DKSH is a logistic company. It in fact is one of the largest distributor in Malaysia. Malaysia is building itself into a distribution hub. Through that, DKSH will be in a good position.

Maybe, AliBaba will want to acquire DKSH? (Purely, speculative) You see, in acquiring DKSH, the Swiss parent, it will be able to acquire a substantial operation for South East Asia region.

Now, since I have road, air and distribution figured out, I am looking for sea (anyone can help here?)

Tropicana and Ecoworld

Everyone knows now that Alibaba is a Top 10 market company globally. It has hence created a lot of millionaires and billionaires. Its employees are definitely doing very well. When they come to Malaysia, they would want to buy nice big homes which are nearer to KLIA - the distribution hub proposed. Ecoworld's EcoMajestic and Tropicana Aman is just 20 km away and they produced the most beautiful homes and "taman" in South Klang Valley. Surely, the employees from Alibaba will be buying or at least renting these homes.

Insas

You see, the largest holding for Insas is a company called Inari. Inari is building semiconductor chips and Alibaba being a technology based company can make use of Inari chips? I am sure there are some relevancy here as Inari produces for Broadcom and Broadcom is very big in data center chip solutions. Alibaba going big into Aliyun (data center cloud services - much like Amazon Web Services) will definitely be beneficial for Inari, hence Insas.

What about me? The poor TA

As you can see, Alibaba is also going big into consumer credit (micro) businesses - through AliPay. Jack Ma knows that he cannot buy a bank as it is not possible regulations wise. He hence looks out for companies that provide transaction services. In Malaysia, some of these companies holds credit lending license - and TA is one of them. TA is in fact ideal as it has the strong credit standing, reach and perhaps the owners are now more keen on doing properties than credit and stockbroking. Hence, Jack! if you want to buy a credit licence, perhaps can consult me? Hey...

Ekovest leh?

Simple. Ekovest is linked to IWCITY. IWCITY is linked to Bandar Malaysia. And Bandar Malaysia is linked to HSR rail and KLIA as well. See...

I hope my story is much more bombastic yet believable than many out there including here, here, and another one from DNEX.

Note: Most of the stories are fake and please do not bring to SC and say that I have been convincing you to buy these stocks. You see, I do not do "pump and dump", because generally I am too dumb not to dump.

However, it is true to my believe that transportation, logistics are key to the growth of e-commerce in the region which is the main gist of my holdings.

Saturday, March 18, 2017

What is not rightly written on JAKS by KYY

KYY has the tendency of not saying it all whenever he writes.

Let me put into perspective. on this article that he writes. (Why I bought in JAKS)

His statements:

What is not correct in his statement?

YTL's IPP during then was the sweetest ever that nobody else would have gotten it. Tenaga was sort of forced to do an offtake. Tenaga was asked to take up YTL's generation whether Tenaga needed it or not. In another words, in layman's term, whether there is such demand for example, 80% of the generation, Tenaga has to take it - even if there is no such usage demand. Another thing which is very important in that deal is that YTL's costs is fixed - meaning the fuel generation costs are already subsidised at a fixed rate. Other parties - if not wrong Tenaga and Petronas has to consume the fluctuations.

Please read this article if you are serious into investing into JAKS.

How Malaysia's IPP was born.

This is obviously correct, as it comes from the horses mouth - the Executive Chairman of Tenaga then, and many more people know about this.

In fact, if you walk into Tenaga and asked people whom are in the know of the deal during those days, they will say, they will never give a project to YTL anymore, NO MATTER WHAT! That was more than 20 years back and many people today will not know about it.

Think about it, if YTL can pull a deal then in a year, why does it need JAKS to pull a deal in Vietnam over 6 years. It is not that sweet.

Another of his statement which is not true until now

Many people also ask me when will I sell my holdings. Since I know JAKS will be making a lot of profit in the next 3 years during the construction and 40% of the profit from the sales of electricity for 25 years, I intend to keep all my shares for many years.

I obviously do not know KYY's net worth - it seems it is a lot, but HE HAS BEEN BUYING ON CREDIT. His purchases if you really read is all on pledged account. He and his wife's. How do you read this? Look at the red boxes.

JAKS although it is good, it is not generating good important cashflow for it to pay dividends even for few years to come. For a person to hold it until beyond 2020, he needs to get the company to pay him back (to support his pledged accounts) - either dividend or capital appreciation! JAKS is not going to pay dividend. Does anyone know that JAKS has never paid dividend before - not in last 17 years! Unless, KYY arm-twist the company to do that it is not obliged to pay dividend. And the company has no cashflow to do that.

If dividend is not forthcoming, he has to sell to pay his interests from the sale of his shares in JAKS. Hence, he will not hold for long term, he will sell some. He is pumping and dumping along the way.

His other holdings e.g. Latitude Tree has proven that.

See below. He bought a substantial stake (more than 5%) and continue to buy more after November 2014.

However, by Nov 2015, he has ceased to be a substantial shareholder. That's a year. He IS NOT A LONG TERM INVESTOR. PERIOD. He buys in and ask you to buy so that he can buy out.

What is unsure...

The profit of about RM400 mil for JAKS will flow back into the JV company to fund JAKS’ equity portion. In other words, JAKS only needs to fork out RM203mil to own a 30% stake in the power plant. JAKS is also given an option to buy up another 10% of the JV company.

Nowhere in JAKS announcement that says it is using the profit to put back into the JV company. Unless, he has inside information, which I would like to know as well. Also, usually, deals are not done that way - unless of course the China partner is such a nice partner - could happen.

What is correct in JAKS?

1. Please read my article here. JAKS in getting this project, assuming they can complete this project will be very good for the company, but one must know that JAKS has only 30% of the IPP (and option to grow to 40%, but even then the costs of buying the additional 10% is not known) - it is not even the controlling shareholder in that IPP anymore. However, the keyword is assuming they complete this project, which I think they can do - but remember it is 2020. At this moment, JAKS is sucking cashflow until 2020.

2. JAKS would not be getting a deal as lucrative as YTL. In fact, no one gets a deal as lucrative as YTL. I again request you to read that article by Kinibiz (put it up again), as it is long and mind consuming to read it - including for me.

3. IPP (or concession like) projects with good IRR is great and I like projects like this - which is also why I bought into company like WCE but they will not get as sweet a deal as that company. It is true that the deal alone made YTL what it is today and even more that you do not see. (Such as with the cashflow, they were able to buy Starhill, Marriott and Lot10 at ridiculous low price during the 1997 crisis - in fact, 1 year profit and cashflow from the IPP enabled it to buy that entire piece of place in Bukit Bintang. That's how powerful it was. YTL Power was generating around RM500 million cashflow and they can buy these prime properties at RM323 million at worst of times, whose money - Tenaga and our rakyat's money!)

4. Despite whatever we can say good abut JAKS, all the good things that is written about JAKS, its main shareholders has not done anything to proof to me they are good directors and will share their returns with shareholders. This I am aware.

What is being speculated by me on KYY's latest article?

I am obliged to declare that I am the largest shareholder of JAKS and that I’m not asking readers to buy JAKS to support its share price. If readers decide to buy, then they are doing so at their own risk.

No, as proven again and again, he is asking us to support the share price so that he can dump onto us. Why? He seems to be in a rock and a hard place. While he has bought until 26% of JAKS, it appears that the current, controlling shareholder is not playing ball. They are calling a placement. It seems that there is no truce yet. The current shareholder can't push up (but fighting) to support KYY's sale, hence calling this placement in such a hurry.

Why I am writing this? I see writing by a so-called super investor as something that people follow a lot. It is important to write responsibly. I am not attacking him but would want to put things into right perspective. In fact, I am holding JAKS as well - not in large volume. I could have let him have his writing and I ride along as well. But investment is not for one to just pump and dump onto other shareholders. But for all to enjoy a long term ride. JAKS can still be a long term share.

I am surprised. I am half his age but yet has more responsibility when writing. (I need more money than him, but all the money in this world is not everything. Moreover, in investment, if one is careful and humble enough, we can survive and do well, better than taking a passive stand - this I believe)

Recently, obviously with the much speculation in shares (which is good), there are many more of these writers whom are just being greedy and irresponsible when writing. Some of whom, I have no intention of even countering. But it is for investors to be really careful and study.

Let me put into perspective. on this article that he writes. (Why I bought in JAKS)

His statements:

Malaysia’s first IPP

The YTL Group was just like any other ordinary contractor before the company was awarded its maiden IPP in Malaysia. From a humble beginning, YTL Corporation Bhd’s market cap today stands at RM1.65 bil (actually this is a mistake, it is RM16.5 billion and much more dividends before this), that of YTL Power International Bhd at RM12.8 bil and YTL Land and Development Bhd (RM578 mil).

Additionally, the YTL Group also owns YTL Cement Bhd, YTL Hospitality REIT, among others.

Investors would recall that on Sept 29, 1992, a total power blackout engulfed the nation for several days. This landmark incident sparked a privatisation of the power generation sector that broke the dawn for IPPs in Malaysia.

In the process, Tenaga Nasional Bhd’s monopoly of the power generation sector was dismantled by then-Prime Minister Tun Dr Mahathir Mohamad as YTL Power was awarded the nation’s first IPP licence in 1993.

As a result, the YTL Group has been making unprecedented amount of profit every year. Before it secured the IPP, the YTL Group was just an ordinary contractor but today, it is so different.

What is not correct in his statement?

YTL's IPP during then was the sweetest ever that nobody else would have gotten it. Tenaga was sort of forced to do an offtake. Tenaga was asked to take up YTL's generation whether Tenaga needed it or not. In another words, in layman's term, whether there is such demand for example, 80% of the generation, Tenaga has to take it - even if there is no such usage demand. Another thing which is very important in that deal is that YTL's costs is fixed - meaning the fuel generation costs are already subsidised at a fixed rate. Other parties - if not wrong Tenaga and Petronas has to consume the fluctuations.

Please read this article if you are serious into investing into JAKS.

How Malaysia's IPP was born.

This is obviously correct, as it comes from the horses mouth - the Executive Chairman of Tenaga then, and many more people know about this.

In fact, if you walk into Tenaga and asked people whom are in the know of the deal during those days, they will say, they will never give a project to YTL anymore, NO MATTER WHAT! That was more than 20 years back and many people today will not know about it.

Think about it, if YTL can pull a deal then in a year, why does it need JAKS to pull a deal in Vietnam over 6 years. It is not that sweet.

Another of his statement which is not true until now

Many people also ask me when will I sell my holdings. Since I know JAKS will be making a lot of profit in the next 3 years during the construction and 40% of the profit from the sales of electricity for 25 years, I intend to keep all my shares for many years.

I obviously do not know KYY's net worth - it seems it is a lot, but HE HAS BEEN BUYING ON CREDIT. His purchases if you really read is all on pledged account. He and his wife's. How do you read this? Look at the red boxes.

JAKS although it is good, it is not generating good important cashflow for it to pay dividends even for few years to come. For a person to hold it until beyond 2020, he needs to get the company to pay him back (to support his pledged accounts) - either dividend or capital appreciation! JAKS is not going to pay dividend. Does anyone know that JAKS has never paid dividend before - not in last 17 years! Unless, KYY arm-twist the company to do that it is not obliged to pay dividend. And the company has no cashflow to do that.

If dividend is not forthcoming, he has to sell to pay his interests from the sale of his shares in JAKS. Hence, he will not hold for long term, he will sell some. He is pumping and dumping along the way.

His other holdings e.g. Latitude Tree has proven that.

See below. He bought a substantial stake (more than 5%) and continue to buy more after November 2014.

However, by Nov 2015, he has ceased to be a substantial shareholder. That's a year. He IS NOT A LONG TERM INVESTOR. PERIOD. He buys in and ask you to buy so that he can buy out.

What is unsure...

The profit of about RM400 mil for JAKS will flow back into the JV company to fund JAKS’ equity portion. In other words, JAKS only needs to fork out RM203mil to own a 30% stake in the power plant. JAKS is also given an option to buy up another 10% of the JV company.

Nowhere in JAKS announcement that says it is using the profit to put back into the JV company. Unless, he has inside information, which I would like to know as well. Also, usually, deals are not done that way - unless of course the China partner is such a nice partner - could happen.

What is correct in JAKS?

1. Please read my article here. JAKS in getting this project, assuming they can complete this project will be very good for the company, but one must know that JAKS has only 30% of the IPP (and option to grow to 40%, but even then the costs of buying the additional 10% is not known) - it is not even the controlling shareholder in that IPP anymore. However, the keyword is assuming they complete this project, which I think they can do - but remember it is 2020. At this moment, JAKS is sucking cashflow until 2020.

2. JAKS would not be getting a deal as lucrative as YTL. In fact, no one gets a deal as lucrative as YTL. I again request you to read that article by Kinibiz (put it up again), as it is long and mind consuming to read it - including for me.

3. IPP (or concession like) projects with good IRR is great and I like projects like this - which is also why I bought into company like WCE but they will not get as sweet a deal as that company. It is true that the deal alone made YTL what it is today and even more that you do not see. (Such as with the cashflow, they were able to buy Starhill, Marriott and Lot10 at ridiculous low price during the 1997 crisis - in fact, 1 year profit and cashflow from the IPP enabled it to buy that entire piece of place in Bukit Bintang. That's how powerful it was. YTL Power was generating around RM500 million cashflow and they can buy these prime properties at RM323 million at worst of times, whose money - Tenaga and our rakyat's money!)

4. Despite whatever we can say good abut JAKS, all the good things that is written about JAKS, its main shareholders has not done anything to proof to me they are good directors and will share their returns with shareholders. This I am aware.

What is being speculated by me on KYY's latest article?

I am obliged to declare that I am the largest shareholder of JAKS and that I’m not asking readers to buy JAKS to support its share price. If readers decide to buy, then they are doing so at their own risk.

No, as proven again and again, he is asking us to support the share price so that he can dump onto us. Why? He seems to be in a rock and a hard place. While he has bought until 26% of JAKS, it appears that the current, controlling shareholder is not playing ball. They are calling a placement. It seems that there is no truce yet. The current shareholder can't push up (but fighting) to support KYY's sale, hence calling this placement in such a hurry.

Why I am writing this? I see writing by a so-called super investor as something that people follow a lot. It is important to write responsibly. I am not attacking him but would want to put things into right perspective. In fact, I am holding JAKS as well - not in large volume. I could have let him have his writing and I ride along as well. But investment is not for one to just pump and dump onto other shareholders. But for all to enjoy a long term ride. JAKS can still be a long term share.

I am surprised. I am half his age but yet has more responsibility when writing. (I need more money than him, but all the money in this world is not everything. Moreover, in investment, if one is careful and humble enough, we can survive and do well, better than taking a passive stand - this I believe)

Recently, obviously with the much speculation in shares (which is good), there are many more of these writers whom are just being greedy and irresponsible when writing. Some of whom, I have no intention of even countering. But it is for investors to be really careful and study.

Thanks to KYY for JAKS

Thanks to KYY for JAKS. At the very least he has managed to get the management of JAKS to issue a private placement at a better price for the current shareholders.

He is not the minority anymore as the latest announcement is that he and his wife owns now close to 26% of JAKS. I believe at RM1.36, he is getting his money worth assuming that JAKS's Private Placement is fully subscribed.

In this round, he has managed to get the management to take care of the smaller guys.

What is he going to do with such high percentage of holding beats me? I however suggest, perhaps he can do a Warren Buffett - i.e. what he did to Berkshire Hathaway 51 years ago. Not too late...

My earlier article on JAKS is below:

Jaks: Great Idea but is it great execution?

He is not the minority anymore as the latest announcement is that he and his wife owns now close to 26% of JAKS. I believe at RM1.36, he is getting his money worth assuming that JAKS's Private Placement is fully subscribed.

In this round, he has managed to get the management to take care of the smaller guys.

What is he going to do with such high percentage of holding beats me? I however suggest, perhaps he can do a Warren Buffett - i.e. what he did to Berkshire Hathaway 51 years ago. Not too late...

My earlier article on JAKS is below:

Jaks: Great Idea but is it great execution?

Thursday, March 16, 2017

Some part of SC's site down

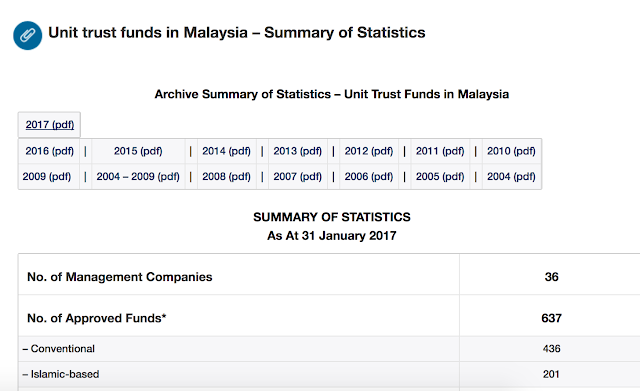

I have been trying to get data on unit trusts - just to understand the growth (or decline) of public's investments.

For Jan 2017, I have managed to get this as below (part of it shown).

However, as I clicked through for 2016 data and even prior to those years, all I got is this. I gave it benefit of doubt for past one week as it was down then, but tried for several times, still down today. Think SC can do better than this.

For Jan 2017, I have managed to get this as below (part of it shown).

However, as I clicked through for 2016 data and even prior to those years, all I got is this. I gave it benefit of doubt for past one week as it was down then, but tried for several times, still down today. Think SC can do better than this.

Tuesday, March 14, 2017

Cronyism still key

Sometimes cronyism is important to certain business - basically see where YTL Power is now. It had done nothing much since. Government changed contracts changes. TNB is not going to give any more new projects to YTL - if yes, there are not going to be as sweet anymore.

The new project as mentioned in the below structure seems very much like JAKS in my previous article - isn't it surprising - a RM500 million company against a RM11 billion company. Both uses China's route.

The new project as mentioned in the below structure seems very much like JAKS in my previous article - isn't it surprising - a RM500 million company against a RM11 billion company. Both uses China's route.

Saturday, March 4, 2017

JAKS: Great idea but is it great execution?

I have to give it to Mr Koon Yew Yin. He sees a good company with a very good project. Basically, Jaks Resources without the power plant project is an average company but with the IPP project it is a more than an average company with an attractive price.

What has it gotten with the IPP in Vietnam? Basically as below, a BOT (transfer - after 25 years) project and its partner CPECC has bought into the project by funding a huge portion of it.

What JAKS has to do now (which it has done) is to fulfill its portion by coming out with USD140.14 million while CPECC will come out with the other portion. In addition, CPECC will build the bulk of the project and come out with Redeemable Convertible Preference Shares (RCPS) to fulfill the equity portion. (On top of that, the RCPS comes with zero dividend costs) CPECC has also gotten the financing for the project as well with its corporate guarantee. It should be noted that CPECC is huge power plant consulting company in China. Its parent, China Energy Engineering is a HKD43B company, which means and says a lot.

The structure is as per below:

Ultimately, JAKS can own up to 40% of the project and it now has a partner whom can deliver. On top of that, it gets a substantial portion of work which can be translated into construction profits from this project.

Do I have reason to believe it can be delivered? Yes.

Do I have reason to trust the project has decent to good return? I should think so considering the interest from CPECC. It has country risks obviously, but this one sounds to be more secure.

Now, all that is good as if it is able to secure good IRR, this basically is a great investment with Jaks trading at about RM535 million valuation. (Jaks has mentioned of it eyeing at least a 10% IRR.)

With that, it is definitely not wrong for a person who understands construction to wallop - and wallop he did. Another point to note is that the controlling shareholder - Mr Ang Lam Poah only owns around 8% to 9% of the company on paper. (I would tend to think he definitely has supports from his other friendly shareholders.) What Mr Ang did wrong was that he took a long time to accumulate the shares, probably thinking of getting them at cheap - below RM1.

Seeing opportunities (probably), Mr Koon Yew Yin bought the shares in a very quick manner and in the process, accumulated more than 11% over a short period of time. (Mr Koon is now, the single largest shareholder) At the point of him becoming a substantial shareholder, it triggered the attention of Ang's group, I believe. Jaks announced an unusual quarterly 31 Dec 2016 loss and at the same time, announced that it is to do a 10% private placement.

Does Jaks has enough bullets to defend the onslaught? I should think so. It has many defensive tools to do that - and it has already done so by announcing a private placements. Private placements as we know can go to friendly parties. Basically, Jaks can do many more of private placements and as long as Koon does not acquire enough to take control - he can't do much. (That has been proven in the case where QL was unable to takeover Lay Hong, and QL I would think is even deeper pockets, but they can't do much.)

Can Mr Koon do much? We shall see. And I do not think he is keen to takeover anyway - as the project is for Mr Ang to lose (he is the person, whom have worked hard to pull everything together), moreover Koon is not in the right age to do that. A new management could jeopardize the project.

Mr Koon's past records have been more of a short to medium term investor - come in - make a kill and go. With that, (I would think) Mr Ang has reasons to be afraid and not to entertain much requests. The ball is in Ang's court to play and decide how to play.

(You see, if I have Warren Buffett as my shareholder, I should feel proud. But, if I have Carl Icahn as my shareholder - I would put on more defences surrounding me, because of animal instincts. In this case though, activists investing may not work well.)

Will someone like Mr Koon ask for a favourable return from the shares? Almost a surety. Why would he invests into Jaks anyway? - and this manner of buying.

The biggest question is - if Jaks current controlling shareholders do not want to play ball - the shares can be stuck at RM1.10 to RM1.30 for a long time - something that a shorter term shareholder would not want! It could end up being you buy to push up your own share price. You can buy but you cannot sell at a profit.

One thing for sure (unless with a deal being made, the private placements may not be that cheap - at least not the type of price which Ang and his group have been buying at i.e. around RM1 - and the way Mr Koon has been buying.)

This is quite interesting turns out and a lesson to note in the long term.

What has it gotten with the IPP in Vietnam? Basically as below, a BOT (transfer - after 25 years) project and its partner CPECC has bought into the project by funding a huge portion of it.

What JAKS has to do now (which it has done) is to fulfill its portion by coming out with USD140.14 million while CPECC will come out with the other portion. In addition, CPECC will build the bulk of the project and come out with Redeemable Convertible Preference Shares (RCPS) to fulfill the equity portion. (On top of that, the RCPS comes with zero dividend costs) CPECC has also gotten the financing for the project as well with its corporate guarantee. It should be noted that CPECC is huge power plant consulting company in China. Its parent, China Energy Engineering is a HKD43B company, which means and says a lot.

The structure is as per below:

Ultimately, JAKS can own up to 40% of the project and it now has a partner whom can deliver. On top of that, it gets a substantial portion of work which can be translated into construction profits from this project.

Do I have reason to believe it can be delivered? Yes.

Do I have reason to trust the project has decent to good return? I should think so considering the interest from CPECC. It has country risks obviously, but this one sounds to be more secure.

Now, all that is good as if it is able to secure good IRR, this basically is a great investment with Jaks trading at about RM535 million valuation. (Jaks has mentioned of it eyeing at least a 10% IRR.)

With that, it is definitely not wrong for a person who understands construction to wallop - and wallop he did. Another point to note is that the controlling shareholder - Mr Ang Lam Poah only owns around 8% to 9% of the company on paper. (I would tend to think he definitely has supports from his other friendly shareholders.) What Mr Ang did wrong was that he took a long time to accumulate the shares, probably thinking of getting them at cheap - below RM1.

Seeing opportunities (probably), Mr Koon Yew Yin bought the shares in a very quick manner and in the process, accumulated more than 11% over a short period of time. (Mr Koon is now, the single largest shareholder) At the point of him becoming a substantial shareholder, it triggered the attention of Ang's group, I believe. Jaks announced an unusual quarterly 31 Dec 2016 loss and at the same time, announced that it is to do a 10% private placement.

|

| KYY's holding has increased to 11.7% by 1 March 2017 |

Can Mr Koon do much? We shall see. And I do not think he is keen to takeover anyway - as the project is for Mr Ang to lose (he is the person, whom have worked hard to pull everything together), moreover Koon is not in the right age to do that. A new management could jeopardize the project.

Mr Koon's past records have been more of a short to medium term investor - come in - make a kill and go. With that, (I would think) Mr Ang has reasons to be afraid and not to entertain much requests. The ball is in Ang's court to play and decide how to play.

(You see, if I have Warren Buffett as my shareholder, I should feel proud. But, if I have Carl Icahn as my shareholder - I would put on more defences surrounding me, because of animal instincts. In this case though, activists investing may not work well.)

Will someone like Mr Koon ask for a favourable return from the shares? Almost a surety. Why would he invests into Jaks anyway? - and this manner of buying.

The biggest question is - if Jaks current controlling shareholders do not want to play ball - the shares can be stuck at RM1.10 to RM1.30 for a long time - something that a shorter term shareholder would not want! It could end up being you buy to push up your own share price. You can buy but you cannot sell at a profit.

One thing for sure (unless with a deal being made, the private placements may not be that cheap - at least not the type of price which Ang and his group have been buying at i.e. around RM1 - and the way Mr Koon has been buying.)

This is quite interesting turns out and a lesson to note in the long term.

DRB has the tendency of not getting deal done

Despite them needing the deal to be completed, this company has the tendency of dragging and over-negotiate. I should know this, for some reasons.

Just to give one example, in the deal where Proton was to be acquired by DRB-Hicom back in 2012, they were required to reduce their stake in Bank Muamalat to an associate stake. Where is that deal now?

The below statement could be a plan by Geely, but I am not too surprised. For Geely to come out and mention this, there are many hiccups it seems in this deal. One must remember for Geely to come into Malaysia and get a deal done, it has to be FRIENDLY. This is a marriage, not a forced takeover. DRB has appeared many times to say that they will continue to have substantial stake in Proton - hence Geely will still need DRB as a partner.

Geely knows. Because they need to get the support to survive in a tough environment. But does DRB thinks and acts that way? Although, they will know as well.

It now goes back to who needs who more. DRB needs to get rid of Proton as it is bleeding more than RM1 billion a year and getting to a 'path of no return' i.e. oblivion. The only way is for it to survive is to do a deal or government to impose taxes which is even higher than the ones during Mahathir days.

With Proton, DRB will be in trouble although it is a separate subsidiary and can be left to rot. Does it want to do that?

If there is a deal which is fair to DRB, then possibly the group could be worth much more than today - but that is still far from the case.

Perhaps, it needs a "Lim Kang Hoo" to show the way...

Just to give one example, in the deal where Proton was to be acquired by DRB-Hicom back in 2012, they were required to reduce their stake in Bank Muamalat to an associate stake. Where is that deal now?

The below statement could be a plan by Geely, but I am not too surprised. For Geely to come out and mention this, there are many hiccups it seems in this deal. One must remember for Geely to come into Malaysia and get a deal done, it has to be FRIENDLY. This is a marriage, not a forced takeover. DRB has appeared many times to say that they will continue to have substantial stake in Proton - hence Geely will still need DRB as a partner.

Geely knows. Because they need to get the support to survive in a tough environment. But does DRB thinks and acts that way? Although, they will know as well.

It now goes back to who needs who more. DRB needs to get rid of Proton as it is bleeding more than RM1 billion a year and getting to a 'path of no return' i.e. oblivion. The only way is for it to survive is to do a deal or government to impose taxes which is even higher than the ones during Mahathir days.

With Proton, DRB will be in trouble although it is a separate subsidiary and can be left to rot. Does it want to do that?

If there is a deal which is fair to DRB, then possibly the group could be worth much more than today - but that is still far from the case.

Perhaps, it needs a "Lim Kang Hoo" to show the way...

Friday, March 3, 2017

IWCITY's deal seems scary but it may not be an Ekovest

There seems to have a chance where IWCITY will be selling its land for over RM2 billion as it has announced a suspension of its stocks. I think it is a 99% chance it will be a done deal.

This is very good for all IWCITY shareholders as the land that has book value of less than RM150 million will be sold for RM2.37 billion (that's a B). Overall, as mentioned in the accounts (subject to change of this new announcement), the profit will be RM1.2billion.

IWCITY's share had run up to RM1.64. Coincidentally, it is going to include another 87 million shares on 6 March 2017 (that day it will be suspended) which was issued for 90 sen (mind boggling) for land in 2 different deals. (For people who wants to know why it is not right, please read Warren Buffett's latest 2016 letter where he mentioned his mistakes of issuing shares for some of his deals)

Hence, the total shares that IWCITY will have is 823,699,857. With that, IWCITY's new market cap will be RM1.35 billion.

Just look at below announcement.

At RM1.35 billion, despite the deal at RM2.37 billion, it is not that cheap as a share. In the sale, if there are not major change, IWCITY is also to spend some RM500 million for the transfer i.e. conversion etc. Unless of course IWCITY decides to issue a huge dividend in the form of around RM1.00 per share. That I will take it.

In all the deals, it looks like IWCITY is a land trader than a real business concern. Ekovest on the other hand, has built itself to have a long runway for it to grow - i.e. from its concession businesses and to a certain extent building into a much bigger construction outfit.

Additionally, there are a substantial number of property companies that are trading well below their book value - among them Sime Darby (especially Sime Properties after the split), Tropicana and many more small companies.

I would like to highlight that IWCITY has issued a 10% placement last year at RM0.90 as below. It certainly diluted its shares at cheap.

Well, until the full announcement is made, I am not going to make much assumptions.

This is very good for all IWCITY shareholders as the land that has book value of less than RM150 million will be sold for RM2.37 billion (that's a B). Overall, as mentioned in the accounts (subject to change of this new announcement), the profit will be RM1.2billion.

IWCITY's share had run up to RM1.64. Coincidentally, it is going to include another 87 million shares on 6 March 2017 (that day it will be suspended) which was issued for 90 sen (mind boggling) for land in 2 different deals. (For people who wants to know why it is not right, please read Warren Buffett's latest 2016 letter where he mentioned his mistakes of issuing shares for some of his deals)

Hence, the total shares that IWCITY will have is 823,699,857. With that, IWCITY's new market cap will be RM1.35 billion.

Just look at below announcement.

At RM1.35 billion, despite the deal at RM2.37 billion, it is not that cheap as a share. In the sale, if there are not major change, IWCITY is also to spend some RM500 million for the transfer i.e. conversion etc. Unless of course IWCITY decides to issue a huge dividend in the form of around RM1.00 per share. That I will take it.

In all the deals, it looks like IWCITY is a land trader than a real business concern. Ekovest on the other hand, has built itself to have a long runway for it to grow - i.e. from its concession businesses and to a certain extent building into a much bigger construction outfit.

Additionally, there are a substantial number of property companies that are trading well below their book value - among them Sime Darby (especially Sime Properties after the split), Tropicana and many more small companies.

I would like to highlight that IWCITY has issued a 10% placement last year at RM0.90 as below. It certainly diluted its shares at cheap.

Well, until the full announcement is made, I am not going to make much assumptions.

Subscribe to:

Posts (Atom)