This same thing I have seen over and over again in my life as an investor / stock trader. If you know what I mean, the year 2014 appears to be a speculative year again. People just like the excitement although they do know that what they are doing is a negative sum game. If it is a negative sum game, why bother? Well, if you look at Genting or Genting Malaysia's shares, we can basically understand - there is never a year where Genting will be on the losing end but still people will just like to take that bet - hoping that their luck will be good that day.

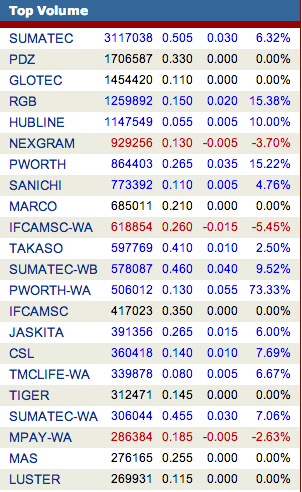

The last few months, it has been a good time for penny stocks, in which case most of them have little investment value. One who have been into stocks market long enough would know that any deals that are announced are just useless deals, but they are welcomed with hope, just like those who goes to a casino in Genting.

I have started tinkering with the market since the early 90s and I have seen this large speculative period in 1992/93 (basically on all stocks including loan stocks), 1996/97 (especially second boarders and could have indirectly caused the collapse of the economy), 2004 (MESDAQ counters, to the extent that Bursa changed the name to ACE Market?) and more recently but less dramatic (the penny stocks). Little do I see the same group of people excited over the same speculative period. Why? Because they have left the market getting burned.

For those whom are still living with that excitement of thinking that you can beat the market this way, well look at it - the world is getting more connected. Systems can get more complex which means that the person can trade from overseas, and not being tracked. They can create an account trading under a foreign company. They have all the information about the stocks and market while those who follow blindly (but thinking they have the information) are just playing to their tunes.

Just read some of these news here and here and here. The point I am trying to make is not on the people whom SC is trying to nab but the stocks. How many of these stocks are still around? Do anyone think they can really beat the market this way by trading on the useless, low value stocks?

Many do not know the best way for any investor to learn is to spend time learning about the business and companies - not the trading patterns. Even for those traders, they have a very strong understanding and hold of the market behaviour, economic conditions and positions of the controlling shareholders. They are not really read through the market movements and take a bet.

6 comments:

That's how most speculators made quick money. Hence, they would never learn as there would always be new speculators joining the game.

Being an investor who look at fundamental is too slow and boring. Nowadays, ppl is feed with the idea of quick, fast and simple money.

Btw, you have not updated your shares portfolio for quite some time.

Hi Felicity, may I get your opinion on Padini's prospect? Will you think it is undervalue at current price and will GST affect Padini adversely? Thanks.

GST will affect consumption but Padini's target market seems good as it is towards the middle income market.

Hi Felicity, may I know your opinion on Bumi Armada? It's giving out bonus issue (2:1) and rights issue (2:1). Is it a good buy?

Ananda krishnan just sold some shares quite substantial - means something

Post a Comment