In any case, I have looked at the continued dwindling of Jobstreet, even after my purchase. It is now trading at RM2.41 (4 Mar 2014) - be prepared for it to drop further, it seems.

Only after the drop, I decided to read in more detail of the entire issue - this is a mistake, one should not do this! One should look and look, to be accurate, read again.

Anyway, this is what I have found - based on the information that is available.

The above shows the ESOS that is outstanding as at 31 December 2013. That would add to the number of shares after new shares are issued to the minority shareholders which Jobstreet, the holding company does not own 100%. In the sale of its business, Jobstreet is doing an exercise and selling the business in its entirety - 100% of all the subsidiaries. Hence, it will need to issue new shares in exchange for the shares in Jobstreet Vietnam, Philippines and Indonesia it does not own. After the purchases, the total number of shares that are outstanding would have increased to 708,244.

However, this does not include the ESOS that can be exercised by the ESOS holders. Hence, I have done a simple calculation as below and try to explain at my level best.

|

| Table 3 |

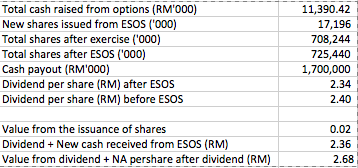

What the above Table 3 depicts is that how many shares would be outstanding assuming that all the ESOS shares are exercised (which I think would be the case as the ESOS are all in the money).

How much dividend would be paid out per share after the full exercise of the ESOS? RM2.34.

However, as the ESOS would involve new cash being injected for the subscription, there would be a net addition of RM11.39 million of new cash from ESOS (first line of Table 3). That translates to RM0.02 per total shares (RM11,390 / 725,440) of Jobstreet.

Based on what's left after the dividend, assuming it gets the full value of its Net Asset Per share of around RM0.32 - RM0.33, the intrinsic value would be somewhere around RM2.68. (Note that I normally do not try to guess the intrinsic value of company except for this situation, which is possible)

I am trying to trust that the management would have concluded the sale by 2nd quarter of 2014 and that is some 4 months down the line at the most. With that, I am now thinking that the currently traded price has a decent what you call "Margin of Safety".

Note: Of course, I am not able to know how many new ESOS would be added between 1 Jan 2014 until now as that has never been revealed by the management of Jobstreet. Of all the good things, that the management of Jobstreet had done, this piece of information is not complete and it is forcing the shareholders to do their own calculation - not right!

Anyhow, I do not really care about the PN17 in this case as it is about the lack of strategic business than it in financial difficulties.

14 comments:

Thanks for the update Felicity. I noticed that the market really was clueless as to how much was to be paid out. Even the analysts were quiet on this.

I personally found their announcement very convoluted. If one can state the total to be paid out (RM1.7bil), why not the pay out per share? I made the same mistake and bought in at RM2.54. Subsequently realised there was more to it and sold off.

I thought it was sneaky not to show the *total* shares outstanding (ESOS + shares issued to purchase the other subsidiaries).

Anyway lesson learnt! Thanks for posting up the calculations!

Hi, your understanding is "After the purchases, the total number of shares that are outstanding would have increased to 708,244". But my fact is After the purchases, the total number of shares that are outstanding would have increased to 691,074.

The 708 million already includes ESOS of 17,196,000

Hi,

I might be wrong but I think the deal has already included the ESOS into it. If you minus off the No. of shares after the proposed disposals and the no. of shares after the proposed acquisition of jobstreet.com Philippines. The amount is the ESOS outstanding.

(Note: upon the issuance of new ordinary shares of RM0.10 each in JobStreet

pursuant to the Proposed Acquisition of JS Vietnam Holdings Pte Ltd, Proposed

Acquisition of JobStreet.com Philippines Inc and Proposed Acquisition of PT

JobStreet Indonesia and full exercise of employees’ share option shares, SEEK

International Investments Pty Ltd’s interest in JobStreet will be 19.9%);

This justify that they already assume ESOS fully exercised.

Hi Felicity Thanks for the heads up...Hv thought about buying into Jobstreet earlier on but didn't managed to do so as was also thinking if I should add on to ntpm.....What do you think of ntpm currently. .. do you foresee better returns in six months time vs Jobstreet?

Hi Jowong7,

Thanks. I think it does not say clearly the 708,244 shares is after the options exercised.

But with the calculation, from 691,074 to 708,244, it seems to be. Then it is even better. The cash dividend per share is to be close to RM2.40 per share and RM0.0175 interim dividend is over and above that I presume. At its current price, one will be getting back all the money with remaining holding in the shares as the extras!

Thanks Felicity for the update.

I think he is right. There is no indication in the proforma effects of NTA that assume full issuance of ESOS shares.

Agree that the lack of transparency in the announcement is not something right to do by the management. The adviser (Hwang-DBS) should also be responsible for providing such misleading information on the proforma effects of NTA.

Nonetheless, I have actually swiftly sold off my position in Jobst at slight loss to fund some other purchases due the Ukraine war scare in recent days. Nothing to do with cut lost or cut mistake, purely stocks selection decision.

Oh I see. jowong7 is correct then. What a confusing transaction! :D

Hi Felicity,

Just a kind highlight. Section 9 in the offer doc.

(Note: upon the issuance of new ordinary shares of RM0.10 each in JobStreet

pursuant to the Proposed Acquisition of JS Vietnam Holdings Pte Ltd, Proposed

Acquisition of JobStreet.com Philippines Inc and Proposed Acquisition of PT

JobStreet Indonesia and FULL EXERCISE of employees’ share option shares, SEEK

International Investments Pty Ltd’s interest in JobStreet will be 19.9%);

Here they mention Seek's stake will be diluted to 19.9% because of purchase of minorities as well as full exercise of ESOS.

Hi GL

I am not in the position to guess where NTPM is heading. What I like about NTPM is that it is a long term investment with the business having resilience as against its competitors.

As for Jobstreet, it is really short term this time around. At the price it is selling for, I would gladly taking something which is almost for sure than an unpredictable.

However, one should be having both types of investments - long term and opportunistic kind of investment. Opportunistics kind, do not come all the time.

Thanks Jowong7, it is different section though, but with your calculation and the rest, I think it is accounted for - which is good as they have taken everything into account.

Cheers

Hi,

What is the conclusion?

Now is rm2.43.

What will we get?

Not announced by Jobstreet yet, but likely to be between RM2.36 to RM2.40.

Thanks.

The Star last month said rm2.72.

Post a Comment