Felicity (14 April 2015)

------------------------------------------------------------------------------------------------------

Investing for me, is about looking for great businesses. This however does not apply to everyone. Some may just want to search for companies that are undervalued to its book value. I do not specifically seek for those stocks. What I usually look for is a business which I can understand, comfortable with. Those that I can see and understand the potential - but those stocks may not be the most undervalued. In fact, it may not be undervalued at all, but as in business, you do not seek for just undervalue but good valuable companies is what you seek.

Most good businesses are usually not undervalued. Good businesses are usually trading at fair value. Seldom are we able to get them at prices which is way undervalued unless, we found those companies at its early stage.

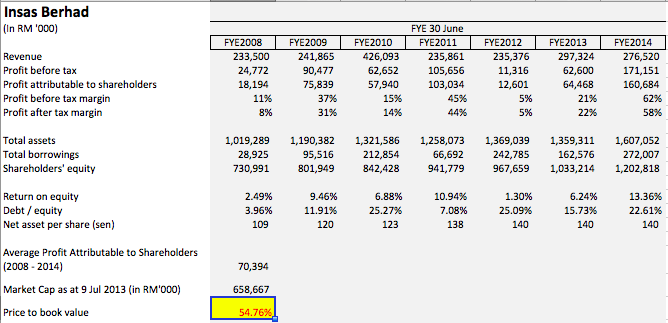

To judge a company's undervaluation based on book value though, it is much easier. A company that is trading at below its book value (with some margin of safety) is presumed to be undervalued. This applies to one particular stock which I am going to introduce as below - Insas Berhad. This company should not be difficult to value as the type of holdings that it has are in the form of investments - largely stockbroking business, Inari Amertron, Ho Hup, Omesti and several other smaller investments.

Is it not one of the most undervalued company by Price / Book Value - trading at 54.76% of its total book value?

If it is so undervalued, why is it then trading at such a valuation? No dividends, perhaps. The company in fact declared its first ever dividend of 1.3 sen last year (2013) and 1 sen each for subsequent 2 years.

Or more so the controlling parties, are contented (with what already have). To address the low price / NA, the management do some shares buyback - and in fact for certain period, they were aggressively buying back their shares. But those shares bought back were redistributed back to the shareholders in the form of share dividends - which makes me wonder on why do they do that. (I however feel that their buying back is the right thing to do rather than dividends.) Insas, should in fact do more buybacks and even at price of RM0.95 these are seriously attractive for buyback.

In terms of performance, as it mainly is an investment holding company in the areas of business which is very cyclical - stocks investment (marked to the fair value of investment), stock broking, some property investments, several IT related businesses, no one seems to be able to foresee what are the prospects or future profitability of these businesses. However, the management did manage to create value (albeit not fantastic) as shown in the growth of its total assets and equity below.

Frankly, I would not judge the company to be poorly run, but it is one of those companies which are just inaggressive where the controlling parties are just too contented with what they have. Once a while, they would have made some good investments as shown below, but these returns are kept at the group level and not shared with shareholders (usually in the form of dividends). Note: since these were written, the management has been much much more aggressive - issuing more funds to buy more businesses. They have been more aggressive in their moves i.e. investing into new companies.

One of the scenario which shows that the management have done some great work is as per below where the company has gained 80% over 3 years. These investments however are the ones which only comes once a while, and will not be contributing consistently to the company.

Part of the statement in Annual Report 2010

Last year, we reported that we made a sizeable investment in London in Chantrey House, a residential cum commercial property in the Belgravia area, a prime property location in central London. In conjunction with our UK partner, we took an equal interest in the investment amounting to 22.5 million British Pounds. Since we purchased that property, central London property prices have recovered strongly. Current prices for apartments in comparable locations are transacting at between 1,200 to 1,400 Pounds per square feet compared to our purchase price of 670 Pounds per square feet. We intend to hold on to this investment as we believe property prices should continue to rise in view of the low interest rate environment.

Part of the statement in Annual Report 2012

I am also pleased to report that subsequent to year end, our 50% joint-controlled entity has accepted offer to sell the London’s Chantrey House property for £37.6 million, and the sale price represents a 80% capital appreciation over our original acquisition price 3 years ago. The sale, when completed, will generate free cashflow in excess of RM50 million to Insas.

What is Insas core businesses then and where is its revenue and profit contribution from? Its main involvement is in the investment holding, trading and financial services and credit (money lending), and leasing (as shown below):

Investment holding as highlighted below is what they do with their cashflow, which means they trade stocks as well as buying bonds and other financial instruments:

Besides stockbroking, money lending and investments into several businesses, one noticeable investment is its associate stake in Inari, a semiconductor company which is doing extremely well. On paper, Insas' holding of 30% + warrants in Inari is already worth RM800 million as at 14 April 2015 (as compared to accounts where it is recorded at book value). Hence, the holdings in Inari is already higher than the market capitalisation of Insas and if one is to account the investments at market, the Net Asset / Share of Insas is more than RM2.50. (Is it not undervalued?)

It has also gone on to purchase the revived Ho Hup Construction, a counter which has a very interesting landbank in Sri Petaling. The property is being managed by the same party who manages Pavilion. Having said that, if it can do achieve a quarter of Pavilion is achieving, it should do well already. (It is different location though - very different)

For most part of its businesses, Insas are involved in mostly cash related trades (or businesses) which means they are liquid traded assets, hence the company should not be trading at that much below its NTA. It is not really a property company in which case the landbank may take a longer time to be disposed.

As many would have thought though (including me), Insas has been trading that way for ages, and the management is not going to change its way of handling the company. Insas has about 33,000 shareholders which means there are quite a number of holders whom are caught holding the stock for a very long time.

As for its future, as long as it is into businesses of investing and stockbroking, it will continue to be the same i.e. pretty volatile. I feel that for it to move upwards i.e. closer to its Net Asset Value, the minority investors have to do something and voice out more so that the management take heed over the voices of the masses. Only then will it trade at its real value.

I do not think the management has taken the shareholders for a ride but they are surely not doing enough to take care of minorities interests.

7 comments:

Felicity

First of all, congrats for a great blog. Job well done. I have not the chance to make any comment. There is always a first time.

Have had the chance to follow Insas for a long time. The share price surely does not provide the right reflection of its value. No doubt like what you said, the most worrying for most investors is whether they can have the chance to participate in the value. The last five year are the better times for Insas. It was doing poorly at one point of time. You introducing the stock is like providing a fresh air to the stock for people like me to take another view.

Insas to me is worth a rerating.

Love your blog for bringing up undervaluation topics like this one. Keep it up bro! :D

Personally, I think Insas is fairly valued. The company has an average 6.7% ROE (based on your data) and that is quite unsatisfactory. To satisfy a minimum ROE of 12% (my own requirement), a maximum P/BV I would tag on Insas is 0.56x (0.067/0.12).

You might say that 0.56x is still higher than the current 0.35x. I blame it to the low dividend yield and lack of dividend track record. Shares buy back is good, but such move to increase shareholders' value is less tangible than paying dividend.

Unless we have a crystal ball telling us that Insas will achieve >8% ROE and pay at least 4% dividend in all the next 3-5 years, if not, the stock is unlikely to be re-rated. My comment is very much financial-oriented, I have to say I didn't look much into the entrepreneurial side of Insas, hence my opinion is a very surface one.

One probably have to go way back to see how Insas changed hands and the financing that went with it. The principal shareholders were probably geared up big time and have been slowly deleveraging through share buybacks and then redistributing through dividend-in-specie over the years. I suspect the big trade receivables figure may contain a big chunk of Insas shares held as margin. The biggest shareholder may also the biggest stale bull! In any case, the company business is quite unfocused and I cannot see how it can grow in a consistent manner.

I will give it a pass.

Hi Robert

I do not think there is much gearing at the level of the shareholder - Thong's family. If there is gearing, I would be the first to jump into the share :) as Insas would for sure be declaring dividend or push up the shares so that they can sell for capital profits. Cash redistribution would definitely be needed to pay off their debts.

:)

APEX's share price is perform well than Insas, from RM0.80 to RM1.40......

APEX should learn from CANONE take over certain amount of shares of Kian Joo, and gain mutually--mutual benefits.

Insas is a good bite for takeover....or at least not expensive compared with APEX or other security-oriented companies.

I invested in this stock as a Graham net net play. It is rare to find one net net play like that in Bursa.

Insas also highly undervalued using Fung, C F's method of valuation using price-to-book with the factor of ROE/Req return.

So the two methods above fit very well.

But I gave up later as it didn't work after quite a long time.

Maybe now the management has decided to distribute dividend may change the mind of investors.

Felicity, why you did not buy INSAS??

Post a Comment