The fact of the matter is that anyone who invests into gold must know that it is a commodity which is dictated by supply and demand. I believe that the reason for people to go crazy over the investments into Genneva Gold's pitch is partly due to the craze over gold as investments. The buzzline has been "cash money as a currency has gotten weaker" if we hold on to cash. Possibly true.

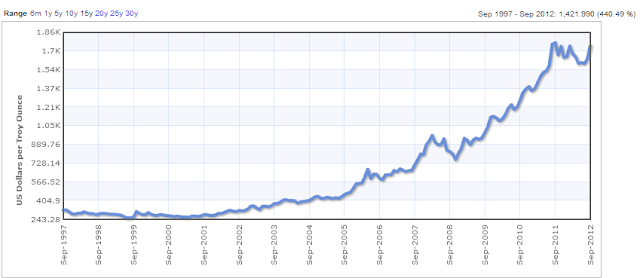

Gold has been a good growth story for the last 10 years or less. Before that, it was not much of a story. See below.

1 year trend

|

| Over the last 1 year, Gold's price has not been doing well for investors |

5 year trend

|

| 5 year trend - its been good as investors rush towards alternative investments as the Fed keeps on printing money |

|

| Prices started to pick up since 2002 - pretty much when most commodities (in fact all) picked up |

Hence, anyone who believed in Genneva Gold or still believes in just GOLD itself for that matter must know that as in any investments, it can go up as well as down. There must be very good reasons for it to move up even further. Inflation? Too much liquidity in the market? Gold is tangible, so you can touch it? - of course my question is what for? Does it pay you dividends? Does it gives a return besides you needing to find a place to store it?

What convinces a person that it will provide positive returns in future?

No comments:

Post a Comment