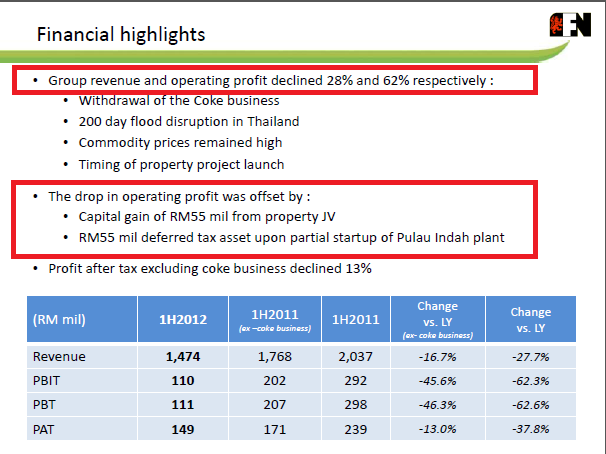

Its poor performance has only been cushioned by the 2 factors - capital gain and deferred tax asset from the Islamic food hub in Pulau Indah which totaled to RM110 million (as reported). These 2 items are not recurring item, hence the significance is not going to be that important.

As I would have expected (in fact I underestimated the impact), the two horse race in the soft drink industry has now become a three horse race - and F&N is the underdog. From there together with the impact from the flood in Thailand, revenue dropped 28%. With 28% drop, the operating profit dropped even more by 62%. So what you see is that any drop or increase in profit from this business is not proportioned to the revenue. The higher the revenue, the profit will increase even more in percentage terms, vice versa.

Now F&N is not enjoying that though. The extremely good results for F&N over last few years was probably due to when Coke was building its own distribution (since the announcement of the split), F&N was probably squeezing the last drop it could have gotten from Coke in that 2 years. Hence, what we saw was the good two years of F&N in 2009 until 2011.

So September 2011 was when the party ended.

And guess what, any company that has lost a good business would obviously be looking for other opportunities - desperately quick. F&N as a result is looking at the dairy business to expand on. By going bigger into that area of business, it is obviously attacking into other competitors that are protecting their turf. From there, you would noticed that the dairy business now will have price competition as well - to the consumers advantage - hence lower margin for the players.

In fact F&N is attacking on all fronts - properties included (through Seksyen 13 land where the old plant is situated). Do you however have that feeling that property is a little bit overpriced at the moment? And if you are interested in a property company, buy a pure property player! F&N is more of a food company.

For this space, Nestle is a better bet despite being expensive as well.

No comments:

Post a Comment